Categories

How Much Can I Borrow For A Mortgage | Max Limits

When buying a new home, the key question is, 'How much can I borrow?' Typically you can borrow around 4.5 times your income, but it is possible to borrow 5.5 to 6 times your income, depending on your circumstances. Is it as simple as using an online mortgage calculator to determine how muc...

Can You Get A Self Employed Mortgage With Only One Year's Accounts?

The short answer is: yes, you can get a self employed mortgage with only one year's accounts. But it is generally more difficult than if you have several years of accounts, as you'll have fewer lenders to choose from. It could also be more expensive, because lenders may offer you higher ...

Tax on Rental Income | Ltd Company vs Individual Explained

Buying a property and renting it out is a great way to have a long-term investment that also makes money each month, but working out the numbers can be complicated and confusing. Add into the mix the options of whether you structure your landlord status as just an individual renting out their sec...

How to Get a Large Mortgage as a Contractor

Looking to get a mortgage as a self-employed contractor can seem like an uphill climb. High-street banks are notoriously inflexible, and gathering together the paperwork to prove you can comfortably make the mortgage repayments can seem frustratingly impossible. However, despite all first impressio...

Applying for Retrospective Planning Permission: Is it Worth the Risk?

Retrospective planning permission is a common occurrence in the property development world. You may have made an honest mistake during building works and only realised afterwards you need permission. Or you may have discovered you can’t sell your house unless it matches the land registry recor...

Can I Remortgage If I Own My House Outright?

You may wonder if you can remortgage your house if you own it outright. When you own an unencumbered (mortgage-free) property, you can use its value as security for a new mortgage and release some of the capital locked up in it. An unencumbered remortgage will give you access to a lump ...

How to Secure a Land Mortgage in 2025

Ever thought about building your own home? We explain everything you need to get a land mortgage in 2025 and how to make the process as efficient and affordable as possible. What is a Land Mortgage? Land mortgages are specialised loans designed for purchasing land. They differ from standard ...

Mortgages and Credit Scores: What You Need To Know

When it comes to getting a mortgage, one of the biggest questions is always ‘will I be accepted’? At Clifton Private Finance, we know that understanding how lenders evaluate you for your application helps provide confidence and assurance - as well as giving you a plan to fix any problems...

How to Release Equity for Home Improvements | 6 Best Options

When you are a homeowner, you soon realise that there’s a financial impact beyond simply paying for the mortgage. While you are repaying the loan you used to buy your home, you will also need to deal with keeping that house in top condition. Many home renovations are minor enough that they ca...

What is Top-Slicing in Buy-to-Let Mortgage Borrowing?

Becoming a landlord remains one of the most effective ways to invest in the UK. Despite occasional headlines regarding market instabilities and fluctuating interest rates, property still delivers - both through monthly rental income profits and property value growth. Increasingly tight regulations ...

Mortgages For Over 60s - The 6 Best Options Compared

Once you reach a certain age, with retirement either already upon you or looming, your mortgage options change. With many traditional lenders unwilling to offer long-term loans for people who might not have the income to meet regular repayments, the mortgage landscape transforms, focusing on releasi...

How Early Can I Switch My Mortgage? (6 Month Windows)

When your fixed rate mortgage starts to come to the end of its term, it’s important to start planning for the future. Doing nothing will result in your mortgage rolling onto the lender’s standard variable rate (SVR), and with SVR rates almost always higher than the other offers availabl...

3 ways to break a property chain

When you are stuck in a property chain and it starts to collapse behind you, everything is at risk. You may need to find new buyers for your home and the delays that come put your plans for moving forward into chaos. Thankfully, there are answers to the problem. With our expertise at Clifton Privat...

Aged 70 Plus? How to Get a Mortgage

The mortgage landscape for retirees may not look quite the same as it does for people in their 20s, 30s, and 40s, but that doesn’t mean financial solutions for people in their 70s are limited. With a range of products designed to help homeowners unlock the capital you have tied up in your h...

NEWS: Are Mortgage Rates Going Down? [June 2025]

The Bank of England has voted to hold the base rate at 4.25% on 19th June 2025. This choice is in line with the government's emphasis on building economic growth and stability in the UK. While the Bank of England previously maintained a hawkish stance on the base rate to reduce inf...

9 Ways to Significantly Reduce Business Costs

At Clifton Private Finance, we are dedicated to supporting businesses through financial management, experienced consultancy, and access to funding. Our expertise gives our clients the freedom to grow confidently, minimising risk and maximising opportunity at every junction. One area that all succes...

9 Ways to Save Business Energy

Regularly evaluating your business energy consumption is an important step towards reaching the UK target of net-zero emissions by 2050. While 2050 may sound far off, it’s only achievable if businesses start making changes now, cutting down on energy usage and switching to sustainable energy ...

How To Reduce Your Business Carbon Footprint

The UK is committed to reaching net-zero by 2050, with an interim carbon target of 68% by 2030. Standing at the centre of this determination to focus on decarbonisation are UK businesses, with eyes turned to every sector to see how improvements can be made. From manufacturing to logistics, marketin...

Divorce Settlement: 3 Ways A Bridge Loan Can Help

Inevitably, marriages don't always go according to plan. And if you're going through a divorce, you may have to face some short term financial challenges on top of all the other strains associated with this difficult time. Expensive legal fees or the urgency to live separately while working thr...

Mortgages For Dentists: How Much Can I Borrow?

The wrangling with HMRC about whether associate dentists are classified as self-employed has caused enormous uncertainty for young associates hoping to buy their first home, remortgage, or build some financial security by investing in a buy-to-let. However, many mortgage lenders understand the valu...

Springboard Mortgages: Are They Right For You?

We all know just how hard it is for people to buy their first house today. Rising rents that make it extremely hard to save up deposits and ever-increasing house prices mean that there are more 18-35 year olds still living with their parents today than at any point in the past century. While many l...

Non-Standard Construction Mortgages & How To Get One

Non-standard construction mortgages are hard to come by. But if you know the right specialist lenders you can still get a competitive deal on your mortgage. Mortgage brokers know the ins and out of the market, and speaking to an adviser is usually the quickest way to find the best non-standard const...

3 Ways to Finance Spanish Property Investment

Investors looking for property investment in Europe often turn to Spain. With a thriving property market that’s shown growth year-on-year, Spanish property is, on average, 40% cheaper than UK equivalents, allowing you to structure development projects with a smaller initial outlay. Navigating...

Bridging Loans For Property Development | How It Works

Bridging loans for property development can get development projects underway fast – but both experienced and first-time developers don’t always fully understand the range of options available. Property development bridging loans are typically only accessible from private or specialist ...

How Important Is Your UK Credit Score To Getting A UK Expat Mortgage?

With any mortgage application, your credit history and score are major factors considered by lenders. So, if you’re an expat living and working abroad, and looking to buy in the UK, you may be worrying that your lack of UK credit history will prevent you from securing a good mortgage deal. Th...

The 9 Best Places to Live in the UK | 2025

Moving to the UK? We've put together a list of the best places to live in the UK if you're an expat or foreign national, rated for affordability, lifestyle, work opportunities and overall happiness. Moving to a new country is a monumental decision that opens the door to fresh experiences, dif...

Bridging Finance for UK expats

If you're a British expat looking to buy UK property, bridging finance could be the key to moving your plans forward. You might be hunting for a residential property to move into, looking for an investment buy-to-let, or contemplating a ground-up development opportunity. Whatever your situati...

Base Rate Drops to 4.25%: The Impact on Businesses

The Bank of England has cut the rate to 4.25% - we explain what this means for your business. The Bank of England has reduced the base rate to 4.25%, lowering the cost of borrowing and offering potential relief to businesses across the UK. This decision comes as policymakers aim to balance inflatio...

BoE Lowers Base Rate to 4.25% | What it Means for Your Mortgage

The Bank of England has voted to lower the base rate at 4.25%, but could further cuts be on the horizon? In February, the Bank of England voted to reduce the base rate to 4.5%, a reduction of 0.25%. In March, it's voted to keep it the same, and in May they've just dropped it again to 4.25%. M...

Confidential Invoice Finance | How It Works

One of the greatest concerns for many businesses looking for invoice finance, is the damage it could potentially have on their B2B client relationships. Understanding what the differing types of invoice finance are, and the subset of confidential invoice finance, will help you select the right prod...

Should You Get a Tracker or Fixed Rate Mortgage in 2025?

The base rate has dropped, and we're taking a snapshot of the best fixed and tracker mortgage product rates on the market today to see how they compare. Written by: Sam Hodgson Inflation has dropped, and it's possible we'll see mortgage rates reduced further before the year is out. Many are a...

How to Successfully Flip a House

The housing market offers many opportunities for profit. Alongside the long-term plan of investing in a property to rent out and eventually sell on many years later, is the short-term business strategy of buy-renovate-resell - taking a property that’s priced low because it’s in need of ...

Remortgage with Bad Credit | What You Should Know

Remortgaging is a standard part of your home-owning life, often used every few years to improve your deal, lower monthly mortgage payments if possible, and make sure you’re not paying too much interest. However, remortgaging involves a full affordability and credit check, which can make the...

Converting a House into Flats - Finance Options & More

In the current UK property and rental market there’s a strong argument for converting larger houses into smaller separate homes in the form of flats. The population of the UK in 2000 was approximately 60 million, and it’s expected to grow to 70 million in 2026 - simply put, that&rsquo...

Equity Release Scotland | What You Should Know

Equity release is a popular product for retired homeowners across the UK, with an increasing number of people enjoying a more financially secure retirement by releasing the money locked in their homes. Subtle differences in culture and rules in Scotland, however, mean that there are some specific p...

Are Product Transfer Mortgages a Good Idea?

When your fixed-rate mortgage is coming to an end, your lender will usually offer you a replacement deal, known as a product transfer mortgage. This is typically the easiest route forward, transferring you seamlessly from your existing mortgage product (the fixed-rate term) to a new one without the ...

Inheriting a House: What You Need to Know

Inheriting a house can be extremely complicated. From the worry of inheritance tax to the potential for disagreements between family members, there’s a lot that goes on behind the scenes of a house inheritance that can make this financial windfall feel more like a burden than a benefit. In th...

Are Part and Part Mortgages Worth It?

Specialist mortgage products exist for many reasons, providing customers with tailored solutions that fit a niche need. One of these is the part and part mortgage, a combination of repayment and interest-only mortgage structures that can provide lower monthly payments while still ensuring the proper...

Does a Student Loan Affect Your Mortgage?

When it comes to trying to work out how much purchasing power you have when looking to buy a house, it makes sense to look into your personal finances to see what might cause a problem - is your student loan one of those things? The answer is both yes and no. Yes, your student loan will affect your...

The Mortgage Application Process Explained

It is normal to be nervous about a mortgage application. When you are looking to make a large and long time financial commitment to purchase a property, it is important that you understand the process and prepare properly. This makes the whole process smoother and gives you the confidence that you&r...

Mortgage Pre-Approvals | What You Should Know

Getting a mortgage isn’t a one-step process. When buying a house, it’s always helpful to know what your budget realistically is before you go shopping - after all, you may have some idea based on your deposit and income, but guesswork is a lot less secure than an actual agreement from a ...

Can You Repay Equity Release Early?

The short answer is, yes, typically you can repay equity release early. Many modern lifetime mortgages offer flexible or partial repayment options - however, early repayment charges (ERCs) may apply, and they can be significant. The ‘lifetime’ in ‘lifetime mortgage’ can crea...

How to Get a Mortgage with Bad Credit and a Good Income

If your credit history is poor, a mortgage can seem out of reach - but if you have the money to pay for it, shouldn’t you be able to find a lender? With Clifton Private Finance, the answer is a confident ‘yes’. Let us explain what you can do to get a mortgage with bad credit it wh...

Mortgage Affordability Checks | What You Should Know

A mortgage is a significant and long-term financial commitment, and mortgage lenders have a responsibility to assess the risk involved to make sure they’re not lending you money that you can’t afford to repay. A mortgage affordability check is simply a way that a lender can look at yo...

How to Build and Manage a Successful UK Property Portfolio

Transitioning from owning a single buy-to-let property to building a substantial property portfolio is a significant step for any landlord. It marks a shift towards property investment as a more structured business venture, offering potential for diversified income streams through rent, si...

NEWS: Will House Prices Drop in the UK in 2025? [April 2025]

Will house prices go down in the UK? The Bank of England base rate has dropped, but interest rates haven't changed significantly - we explain why and how it affects UK house prices. The 2025 housing market is off to a good start. Inflation has remained relatively stable since the Autumn Budge...

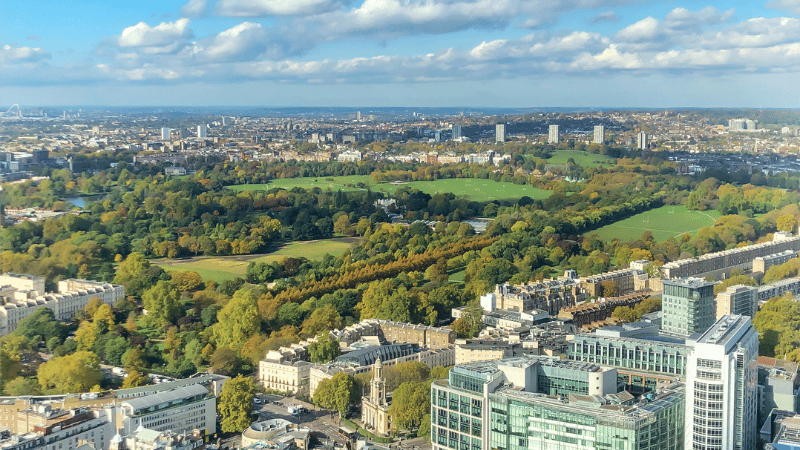

6 Best Places to Live in London - The Full Guide

London is one of the most popular places to live in the world. With access to globally renowned educational facilities and a thriving jobs market, London is naturally the most popular city in Britain to settle in. According to the UN, the UK is one of the top 20 happiest places in the world. If you...

What Happens to Your Mortgage if You Move Abroad

If you’re a homeowner planning to move abroad, you’ll be pleased to know that your mortgage won’t be affected significantly if you decide to leave the country. However, you will need to let your lender know and apply for a consent-to-let if you plan on renting your home out while ...

NEWS: Investing in London Property | Is Now a Good Time?

London’s once red-hot property market has cooled significantly in recent years, leaving investors wondering whether now is the right time to buy. The latest data suggests a mixed picture: while house price growth has slowed and profits for sellers have halved since 2016, upcoming shifts in mo...

3 Types of Second Home Tax and How to Plan For Them

The UK property market has long been a complicated investment landscape, with the likelihood of significant gains based on a strong history of property value increases, as well as a strong rental and holiday let potential. However, as the UK government seeks to address the housing crisis, taxation i...

NEWS: Spring Budget 2025 - How it Could Affect Your Mortgage

This year’s Spring Statement unfolded on Wednesday 26th March, and the British public are keen to understand how the latest economic measures will impact our finances. Chancellor Rachel Reeves pledged to maintain stability by limiting major fiscal changes to a single annual Budget. The result...

How Are Home Equity Loan Rates Calculated

Home equity loans, also known as second charge mortgages, are a powerful way for homeowners to make use of their greatest asset - their home. With a home equity loan, property owners can access large levels of finance to help them in other aspects of their lives, whether it’s for further inves...

What the Mortgage Proof of Deposit Is - And Why You Need It

The idea of falsely claiming to have a deposit on hand to obtain a mortgage is not one many of us would likely consider, but it is still something lenders have a responsibility to check thoroughly. A mortgage proof of deposit is an important part of making sure your mortgage application is smooth. ...

Is There a Maximum Age for a Mortgage in the UK?

The maximum mortgage age in the UK typically ranges from 75–85 years, depending on the lender. Options like shorter terms, joint mortgages, or pension income can help you secure a mortgage later in life. Clifton Private Finance can help when it comes to helping understand lender age caps, pens...

Joint Mortgage Paid by One Person | What You Should Know

When you take out a joint mortgage, it is treated as if you and your partner are one entity, equally responsible for repaying the mortgage and with equal ownership of the home. A core product for couples, joint mortgages have many advantages in the way they are assessed, bringing the power of two i...

NHS Mortgages | What You Should Know

Respect and support for key workers exists across all sectors of the UK, including that of the mortgage industry. This leads to unique mortgage options for NHS staff, with specialist NHS mortgages representing a superior deal with higher value loans and potentially better mortgage rates than are ava...

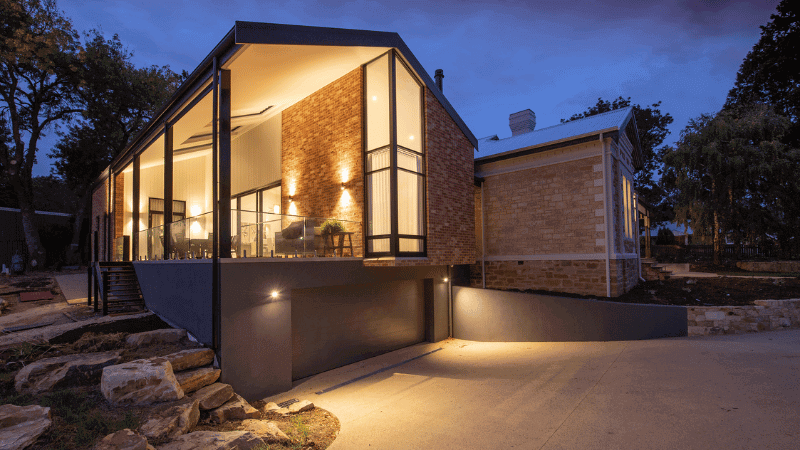

Are Farm Renovations the New Property Trend of 2025?

Renovating a farmhouse: dream development or a money pit? We look into the details of the UK's most popular conversion project. Farm renovations and barn conversions are emerging as some of 2025's most popular property trends. As farming processes evolved over the past century, more of our i...

100% Bridging Loan | How it Works

If you're looking for a bridging loan to cover the total amount of a property's value – you'll need a 100% bridging loan, or 100% LTV (Loan-To-Value) bridging loan. This means you don't need to put down any deposit for your bridging loan, and can borrow the full value of the property yo...

How to Get a Skilled Worker Mortgage

You may be wondering if you can buy a house in the UK on a skilled worker visa - and the answer is a resounding yes! There are some additional challenges, but it is very much possible with the right lender. A Skilled Worker Visa (also known as the Tier 2 visa before Decembe...

NEWS: A Guide to the Most Expensive Streets in the UK

Are you dreaming of living on one of the most expensive streets in the UK? Or perhaps you're just curious about what makes a truly prime property location? In this post, we take a tour of the streets with the highest average property prices in each area of the UK, according to recent data...

Remortgaging After Bridging Finance | How it Works

Bridging loans give you the power to buy property quickly, opening opportunities that a standard mortgage simply cannot provide. But bridging solutions are short-term finance that are designed based on an exit strategy that typically sees them paid off within a year. How is that done? The primary...

How To Remortgage A Buy To Let Property

You may be considering if the time is right to remortgage your buy to let property. You could find a better deal or release some equity for further property investment. Here we explore why you might want to remortgage a buy-to-let property (BTL), what considerations you need to make,...

Buying Property in London as a US Citizen: 9 Things You Need to Know

If you're interested in buying property in London as a US citizen, you're not alone. And if you're wondering how easy it is to get a UK mortgage as a non-UK national, the good news is there are plenty of specialist lenders who will be willing to make you an offer. Written by: Sam Hodgson ...

How Do Mortgage Interest Rates Work?

Your mortgage interest rate is one of the most important factors to consider when buying a home - so how does it work? Interest is charged on every pound you borrow, so the higher the rate, the more you’ll pay back. If you're applying for a mortgage, it’s a good idea to understand the ...

A Guide To Bridging Loan Interest Rates

Bridging loan interest rates - how do they work and what can you do to keep costs down when using bridging finance to fund a property purchase? Bridging loans can be an excellent way to finance property and are often best suited to circumstances that demand speed and flexibility. theme-element?4...

Is Bridging Finance a Good Idea?

Generally speaking, bridging loans are a good idea so long as you fully understand the costs and risks weighed up against the benefits they provide to your property transaction, and ideally work with an independent adviser, such as ourselves, to walk you through the process before you commit to a lo...

Can I Buy a House in the UK from Abroad? | 2025 Insights

There are a lot of myths and misconceptions about buying a house in the UK from abroad. Is it possible? The answer is a resounding YES. You might be a non-UK national looking to invest in the UK property market or an expat looking to buy property while you work overseas. Whatever your circumstances...

How to Get a Limited Company Buy to Let Mortgage

It has become more challenging to turn a profit as a landlord in recent years, but using a limited company buy to let mortgage could help you save and boost your margins. Here's how you could get one.. Written by: Sam Hodgson Whether you're buying your first investment property, or ...

What is Gazumping? 5 Ways to Avoid It

Being gazumped when buying a house is more than just frustrating - it can be financially and emotionally devastating. The strange, almost comic-sounding word ‘gazump’ is believed to come from the Yiddish ‘gezumph’, meaning to be cheated or overcharged - but there’s noth...

How much deposit do you need for a buy to let?

How Much Deposit do you need for a Buy-to-Let? You typically need a 25% deposit for a buy to let mortgage. However, some lenders will approve loans with 20%, or even 15% deposits, but they usually come with higher interest rates and/or product fees. To get a free comparison of the best opti...

Finance for Tech Companies | 10 Unique Options

Technology companies sit in a unique and modern financial position that comes with its own funding challenges. Often, a tech company requires significant upfront capital and investment to get off the ground, with considerable research, development, and marketing needs. With a business model that m...

Is Renovating Still Profitable in 2025?

The UK housing market has long been a haven for property renovators looking to turn a profit. But in 2025, with mortgage rates still relatively high and increased material costs, many are questioning if the renovation boom is finally slowing down. One of the biggest challenges facing renovators tod...

The Ultimate Guide to Buying Property in St John's Wood

St John's Wood stands as a prestigious and sought-after neighbourhood, favoured by affluent families, successful professionals, and international buyers seeking a blend of urban sophistication and leafy tranquillity in Prime Central London. This comprehensive guide explores St John's Wood's propert...

The Ultimate Guide to Buying Property in Regent's Park

Regent's Park, a crown jewel in London's property landscape, offers an unparalleled blend of regal history, verdant open spaces, and prestigious residences. This iconic area, home to the eponymous Royal Park, London Zoo, and world-class cultural institutions, has long been a magnet for discerning bu...

The Ultimate Guide to Buying Property in Maida Vale

Maida Vale, a charming and sought-after neighbourhood in West London, offers a unique blend of tranquil residential streets, picturesque canals, and excellent transport links. Known for its elegant Edwardian and Victorian architecture, tree-lined avenues, and the famous Little Venice area, Maida Val...

The Ultimate Guide to Buying Property in Kensington

Kensington stands as a vibrant and affluent neighbourhood, long favoured by young professionals, celebrities, and wealthy families seeking the epitome of luxury living in Prime Central London. This comprehensive guide delves into the area’s property market, exploring pricing trends, rental yi...

The Ultimate Guide to Buying Property in South Kensington

South Kensington stands as one of Prime Central London's most desirable neighbourhoods, renowned for its grand Victorian and Edwardian architecture and proximity to iconic cultural destinations. Favoured by affluent individuals, this upscale area offers a unique blend of historic charm and modern ...

The Ultimate Guide to Buying Property in Notting Hill

Notting Hill: a vibrant jewel in the heart of Prime Central London (PCL), celebrated for its picturesque streets, dynamic cultural scene, and prestigious properties. Here, in this detailed guide, we at Clifton Private Finance will walk you through an in-depth look at the local property landscape. E...

The Ultimate Guide to Buying Property in Holland Park

Holland Park's unique blend of natural beauty, historic charm, and urban sophistication makes it an enduring favourite in the Prime Central London property market. Despite recent market fluctuations, the area's fundamental appeal remains strong, offering excellent opportunities for both homeowners a...

The Ultimate Guide to Buying Property in Knightsbridge

Knightsbridge is quintessentially prime central London (PCL), epitomising luxury and exclusivity in one of the world's most desirable residential property markets. At Clifton Private Finance, we proudly guide discerning clients through the nuances of this prestigious market, providing tailored fina...

The Ultimate Guide to Buying Property in Belgravia

Belgravia, one of London's most exclusive and elegant neighbourhoods, offers an unparalleled blend of historic grandeur and modern luxury. Known for its white stucco-fronted townhouses, pristine garden squares, and prestigious address, Belgravia exudes sophistication and global allure. This compreh...

The Best Areas in Prime Central London for Property Investment

Prime Central London's allure as an investment destination is undeniable. While property values in the city centre are among the highest in the world, the area's enduring appeal, limited supply, and strong demand from affluent buyers contribute to its resilience and potential for capital appreciatio...

How To Invest in Prime Central London Property

The PCL property market has demonstrated remarkable resilience amidst economic challenges, positioning itself for a promising outlook in 2024. As the UK economy is expected to grow, putting the property market on a more optimistic track, the PCL sector has already showcased its strength. In 2023, ...

The Ultimate Guide to Buying Property in Mayfair

Mayfair stands as the epitome of luxury and exclusivity in Prime Central London. Favoured by high-net-worth individuals, this prestigious neighbourhood boasts world-class amenities. Such as: fine dining, bespoke tailoring, renowned art galleries, and lush parks, catering to a discerning clientele th...

The Ultimate Guide to Buying Property in Chelsea

Chelsea stands as a trendy and affluent neighbourhood, long favoured by young professionals, celebrities, and wealthy families seeking the epitome of luxury living in Prime Central London. This comprehensive guide delves into the area's property market, exploring pricing trends, rental yields, and...

The Ultimate Guide to Buying Property in Marylebone

Marylebone, a gem in the heart of London, offers a unique blend of village-like charm and urban sophistication. Known for its elegant Georgian architecture, chic boutiques, and proximity to some of London's most beloved green spaces, Marylebone has become one of the most sought-after residential are...

NEWS: The London Boroughs Climbing in Value Despite Property Slump

London’s property market shows a tale of two cities in 2025, with some areas witnessing unprecedented growth while others reveal steep declines. Against a backdrop of economic uncertainty, the market is offering unique opportunities for buyers, driven by notable price adjustments, increased s...

What is a UK Reverse Mortgage? | Explained

A reverse mortgage, or lifetime mortgage is one of a range of equity release products that allow those aged 55+ access the money locked into their home. At Clifton Private Finance, our equity release specialists are here to help you get the reverse mortgage you need, properly UK regulated and desi...

Distributor Finance | What You Should Know

Specialist business finance allows you to optimise your funding options to tailor solutions to your need - distributor finance is no exception. With a clearly defined goal of providing the funding required to secure stock for resale, distributor finance forms part of the suite of supply chain fina...

How To Get A UK Mortgage With A Foreign Income

Whether you're working abroad or a British resident earning in a non-pound sterling currency, applying for a mortgage with a foreign income can have its obstacles. Many high street banks will shy away from borrowers on a foreign income. Still, whether you're earning in Euros, Dollars, or Yen,&...

Unlocking Opportunities with 100% Development Finance

100% development finance can play a pivotal role in bringing ambitious property projects to life. It can provide the necessary capital for developers to acquire land and finance construction. Is it possible to find a lender willing to finance 100% development costs? Yes, but only if y...

How to Get a Joint Mortgage with a Non-UK National Partner or Spouse

Getting a joint mortgage where one partner is not a UK national can be challenging. We have a strong track record in matching international clients with the lending they need. Buying a home together is an exciting milestone, but for couples where one partner is not a UK national, securing a joint m...

What Deposit Do You Need For Bridging Finance?

Bridging finance is an important tool for flexible property purchasing, allowing you to move quickly in a vibrant marketplace, cutting through red tape to complete property purchases far more rapidly than with a mortgage. You generally need at least a 20% deposit, or, 'equity', for a bridging loan....

Lifetime Mortgages | A Down-to-Earth Guide

Retired homeowners can often feel financially frustrated. You’re sitting on a strong asset - your home - but the money is locked in it. Often, those in retirement are struggling on their pension, getting by but not enjoying their later years as much as they’d once hoped they would. Nee...

Tenants in Common Mortgage | 6 Pros & Cons

Houses are expensive and mortgages can be difficult to get - especially if you’re leaning on just one income. While married couples are typically catered for with joint mortgages that list both spouses as homeowners, are there other options? The answer is yes - a tenants in common mortg...

Interest Only Vs Repayment Mortgage: Which Is Best?

The main difference between an interest-only mortgage and a repayment mortgage are the way your monthly mortgage payments are structured. When buying a home, the two most common types of mortgage loans available are interest-only mortgages and capital repayment mortgages. An interest-on...

What Proof of Income Do I Need To Get a Mortgage?

It varies from lender to lender, but mortgage providers will require the following proof of income for your mortgage application: 1-3 of your most recent payslips Your P60 (for up to 2 years) Evidence of 2-3 years of bonuses if they're a significant chunk of your ...

Revolving Credit Facility | The Best Options Compared

A revolving credit facility, sometimes called a “line of credit”, is one of the more powerful tools available to businesses looking to manage their cashflow. But how does it work and what makes it different to the other types of business finance? More importantly - how can you use a rev...

NEWS: 1 in 3 Britons Find Mortgage Jargon Difficult to Understand

A new survey has revealed that 35% of Britons believe mortgage product names are difficult to understand, with many feeling uncertain about their knowledge of key financial concepts. The research highlights gaps in financial literacy in the UK, particularly among first-time buyers. Many feel overwh...

What Challenges Will Businesses Face in 2025?

Whether you’re a newly starting business owner, or a major corporation, 2025 is going to be a major turning point for businesses. So, what should business owners expect to face in 2025? At Clifton Private Finance, we’re here to offer expert, tailored advice to businesses of any size, wh...

.png)

.png)

.jpg)