Categories

How to Secure a Land Mortgage in 2024

We explore the intricacies of securing a land mortgage in 2024, providing expert insights and tips to help you navigate the process with confidence.

What is a Land Mortgage?

Land mortgages are specialised loans designed for purchasing land. They differ from standard residential mortgages due to the unique nature of land ownership. Furthermore, the lenders that offer these types of loans will have specific requirements.

Land mortgages are commonly used for various purposes, such as purchasing residential property, commercial real estate, agricultural land, or vacant land to build on.

The terms of a land mortgage, such as the interest rate, repayment schedule, and loan duration, may vary depending on your circumstances and the land you're looking to purchase.

Skip to:

Land Mortgage Eligibility Criteria

Can I get a Land Mortgage with Bad Credit?

How can a Mortgage Broker Help?

Types of Land Mortgage

Different types of land mortgages cater to specific land uses and the requirements associated with that type of land. Each type will have its own unique terms and conditions, making it essential to choose the right loan for the intended use of your land.

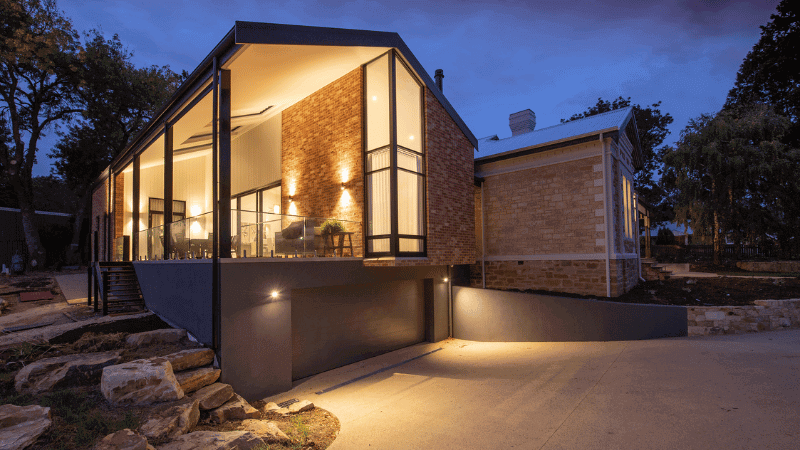

Self-build Mortgage

A self-build mortgage is designed to help you finance the construction of your own home. They typically release funds in stages as construction progresses.

Unlike traditional mortgages, which are used to purchase an existing property, a self-build mortgage provides the funds needed to cover the costs of building a new home from the ground up.

A self-build mortgage is ideal for those who wish to have more control over their home's design, features, and layout.

Agricultural Mortgage

Agricultural mortgages are designed for purchasing land to be used as smallholdings or leased out to local farmers.

Lenders assess the value of the agricultural property being financed. This includes evaluating factors such as the land's fertility, location, infrastructure, and potential for income generation.

Agricultural mortgages can have different structures. Some might involve a lump-sum loan payment, while others might involve a drawdown mechanism similar to development loans, releasing funds as various phases of the agricultural project are completed.

Woodland Mortgage

Woodland mortgages enable individuals to acquire ownership of a parcel of woodland. Because there is less opportunity to buy woodland in the UK than, say, a home or commercial land, most lenders will generally be less accustomed to this type of mortgage and may be unable to offer it.

But there are specialist lenders who can facilitate a woodland mortgage. Due to the niche nature of this type of mortgage, your intended purpose for the land will be especially important in your application.

Commercial Mortgage

A commercial mortgage for land is a finance solution for businesses or individuals looking to acquire land for commercial purposes. Commercial mortgages are more versatile and can be used to buy buildings and land for commercial use.

In this context, a commercial mortgage is tailored to buy land that will be used for business activities, such as retail, office spaces, industrial facilities, or development projects.

See Similar: London Airspace Development - How to Secure Finance

Land Mortgage Eligibility Criteria

When assessing a land mortgage, several factors come into play, such as affordability, credit score, deposit, valuation, planning permission, and land use.

When evaluating your affordability for a land mortgage, it's common for lenders to perform an income stress test, so it's crucial to make sure your income will cover your loan payments before you apply.

A high credit score is also beneficial, as it will influence what LTV ratio and interest rates will be available to you.

The type of land you're buying, and its intended use also play a significant role in determining your interest rates. For instance, land designated for agricultural purposes may have lower interest rates than residential land.

Moreover, the land valuation and whether or not you have planning permission will typically influence the terms of the loan.

While having planning permission isn't always mandatory, it's generally preferred by lenders and can impact the approval process.

In addition, most land-based mortgages typically require a loan-to-value ratio of 70% or less, so you'll need to provide at least a 30% deposit.

Obtaining a Land Mortgage: The Application Process

Land mortgages are a niche finance solution usually only offered by specialist lenders. The application process for a land mortgage can be more complex than a standard residential mortgage.

You'll need to meet eligibility criteria and provide the necessary documentation to support your application. This may include proof of income, business plans, budgets, planning permission, and credit reports. Understanding how land mortgage work can help you navigate this process more effectively.

Working with an experienced broker can simplify this process and help you navigate any complexities you encounter.

At Clifton Private Finance, we have relationships with private banks, specialist lenders, family offices, and wealth managers. We can find the best lender for your needs and get you the best deal on the market for your circumstances.

Required Documentation

When applying for a land mortgage, you’ll need to provide several documents to support your application. These may include proof of income, such as pay stubs, tax returns, bank statements, and proof of deposit. You'll also likely be required to show detailed plans for the land purchase and any further developments you are considering.

Preparing this documentation in advance can streamline the application process and may reduce the processing time significantly.

Interest Rates & Deposit

The cost of a land mortgage can vary significantly based on several factors, including the lender, your financial situation, market conditions, and the specific characteristics of the land being financed.

The main costs you'll need to pay attention to when applying for a land mortgage are interest rates and deposit amount.

Interest rates

Interest rates for a land mortgage may vary depending on factors such as credit score, intended land use, and overall market conditions. Generally, the better your credit score and the lower the loan-to-value ratio, the more favourable the interest rates you may be offered.

The intended use of the land can also impact interest rates, with agricultural land potentially having lower rates than residential land. Market volatility can further influence rates, making it crucial to stay informed about current market conditions when seeking a land mortgage.

It’s important to compare interest rates from different lenders to find the best deal, as well as take into account the various deposit requirements based on the type of land and your financial standing.

These are all factors that an experienced mortgage broker can help you navigate. At Clifton Private Finance, our team have extensive knowledge of the market and relationships with specialist lenders who may be able to offer finance products tailored to your needs.

Deposit

A deposit is the initial payment you make upfront when purchasing land or property using a loan. Lenders typically require a deposit as a percentage of the total purchase price of the land.

The exact percentage will vary depending on factors like the type of property, your creditworthiness, and the lender's policies. Common deposit percentages for land mortgages range from 30-50% of the purchase price and can be even higher, especially for raw land without existing structures.

Is Buying Land With Planning Permission Worth it?

Planning permission is essentially official approval from the local government or relevant authority to carry out specific types of development or construction on a piece of land. It's an important part of a loan mortgage application because it directly affects the land's value, feasibility, and potential use.

Lenders want to ensure that the land being purchased can be legally developed or used according to the borrower's intended purpose. Having planning permission provides confidence that the land can be developed as planned without legal obstacles.

As well as this, land with planning permission already in place will generally be of higher value than that without it.

How Else Can I Fund a Land Purchase?

There are several other financing options available for land purchases. These include equity release, remortgage, and personal or business loans.

Each of these options has its advantages and drawbacks, so it’s essential to carefully consider your financial situation and needs.

Equity Release

Equity release is a financial solution that enables homeowners to access the equity in their property to finance a land purchase. By leveraging the value of your existing property, you can acquire additional funds for purchasing land without having to sell your home.

This can be a convenient and flexible option for those looking to expand their property portfolio or build a new home on a separate plot of land.

Remortgage

Remortgaging involves taking out a new mortgage on your existing property to release funds for a land purchase. This process allows you to settle your existing mortgage while using the remaining funds to acquire land.

Remortgaging can be a viable option for homeowners with sufficient equity in their property, but it’s important to weigh the potential benefits against the costs and risks associated with refinancing your existing mortgage.

Personal or Business Loans

Personal or business loans can be used to finance a land purchase, providing an alternative to land mortgages. These loans may come with higher interest rates and shorter repayment terms, but they can offer greater flexibility regarding loan conditions and eligibility criteria.

It’s essential to carefully consider your financial situation and needs when exploring personal or business loans for land purchases, as well as compare the terms and rates offered by different lenders.

How To Buy Land

Buying at auction, using an estate agent, and private sales are three common land purchase methods, each offering different advantages and considerations.

Buying Land at Auction

Purchasing land at auction requires a 10% deposit on the day of the auction and full payment within 28 days. This accelerated timeline makes it crucial to have a decision in principle before participating in an auction.

The competitive nature of auctions can make it challenging to secure a plot at your desired price, but it can also allow you to get a great deal on a piece of land.

Private Sales

Private sales offer more flexibility in terms of negotiation and financing. In a private sale, the buyer and seller negotiate directly without the involvement of an intermediary, such as a land agent or an estate agent. This method requires more research and due diligence on the part of the buyer, as there is no third-party intermediary to provide guidance.

However, private sales can offer a more personalized experience and greater control over the negotiation process.

Estate Agents

You can also use a third party, such as an estate agent or a land buyer. On many large estate agent websites, there is an option to search for land in the area of your choice, and the estate agent will be able to offer you some options based on what you're looking for and help facilitate the sale.

A land buyer is a little more specialist and offers a service usually enlisted by housing developers. A land buyer can liaise on your behalf to find land closely suited to your needs.

Can I Get a Land Mortgage With Bad Credit?

Having bad credit can make securing a land mortgage more challenging, but there are options available.

Firstly, some specialist lenders can accommodate borrowers with adverse credit and may be able to offer you a land mortgage.

It's worth noting that if you have poor credit, you may be subject to higher interest rates and stricter terms, but if you're looking to purchase land, this can still be a viable option.

What Else Can I Do?

If you have adverse credit and are looking to finance a land purchase in the future, it can help to take some steps to address your credit issues before you begin your search.

Providing a larger deposit can also increase your chances of approval and potentially get you better rates, especially if you have a strong business plan for the land’s intended use.

You can start by reviewing your credit history and making sure it is accurate. In the case that there is inaccurate data on your report, you can contact the credit report company and have it corrected.

Where possible, taking the time to work on gradually improving your creditworthiness may help ensure there are better deals available to you when you are ready to begin your search.

Taking steps to improve your financial standing and working with an experienced broker can help increase your chances of securing a land mortgage, even with bad credit.

How Can a Mortgage Broker Help?

Land mortgages are typically more complex than standard residential mortgages. Working with a specialist broker familiar with these loans' intricacies can make the process significantly smoother.

A suitable broker will have access to a wide range of lenders and expertise in the unique requirements and challenges associated with the finance solution you need.

By enlisting the help of a finance broker, you can confidently navigate the application process and secure the best product for your needs.

Navigating Lender Options

A good broker can help you navigate the available lender options and can ensure you secure the best land mortgage terms and rates for your specific situation.

By assessing the factors that affect what deals are available to you, your broker can identify the most suitable lender for your needs.

At Clifton Private Finance, we offer award-winning client service and an exceptional team of brokers. We can guide you through the application process and help you understand the qualification criteria and financing options available to you.

Call us today on 0117 959 5094 to see how we can help, or book a consultation with us below.

FAQs

Is it possible to get a mortgage on land?

Yes, it is possible to obtain a mortgage to buy land. However, there are specific criteria to be considered, and not every lender can facilitate this type of loan.

Is getting a mortgage on land the same as a house?

Getting a mortgage on land is not the same as getting one for a house, but lenders have lending products to match every land purchase situation.

It's important to note that a limited lending pool and a more complex loan type will usually mean higher interest rates, a larger deposit requirement, and stricter eligibility criteria.

What factors affect interest rates for land mortgages?

Interest rates for land mortgages can be affected by various factors, such as credit score, loan-to-value ratio, land use, and market circumstances.

How can I improve my chances of securing a land mortgage with bad credit?

To improve your chances of securing a land mortgage with bad credit, you can address any underlying credit issues, provide a larger deposit, and present a strong business plan for the intended use of the land.

You can start by obtaining a copy of your credit report and addressing any errors or discrepancies.

Increasing the size of your deposit can demonstrate your commitment to the loan and may mean that lenders offer you more reasonable interest rates - saving you money in the long run.

What is the difference between buying land at auction and private sales?

Buying land at auction requires a 10% deposit and full payment within 28 days, while private sales offer more flexibility in negotiation and financing options.

.png)