Categories

10 Best Places to Live in Australia as a British Expat

Emigrating to Australia is not a new idea. British expats who seek sunshine and adventure have been looking to the other side of the world for decades. Australia has a charm and cultural kinship with the UK that is hard to dismiss, making it one of the most compelling places in the world to move to...

8 Ways Construction Companies Can Make the Most of Asset Finance

With an ongoing need for modern plant and essential infrastructure, construction companies can often feel the squeeze on capital. Asset finance provides a powerful and flexible funding tool that’s specifically developed to leverage the value in assets to keep capital expenditure low and monthl...

11 Home Improvements That Do Not Add Value in the UK Market

Turning your home from the place you first bought into something that really reflects your use and taste is an exciting part of home ownership, however, too many home improvements that do not add value can become extremely costly. The truth is that not all home improvements are equal, and future bu...

8 Ways Transport and Logistics Companies Can Make the Most of Asset Finance

As the industry positioned as the core of global supply chains, transport and logistics (T&L) companies are under intense pressure to ensure the equipment and machinery they use represents the very best on offer. The level of capital investment required to keep competitive in a fierce business ...

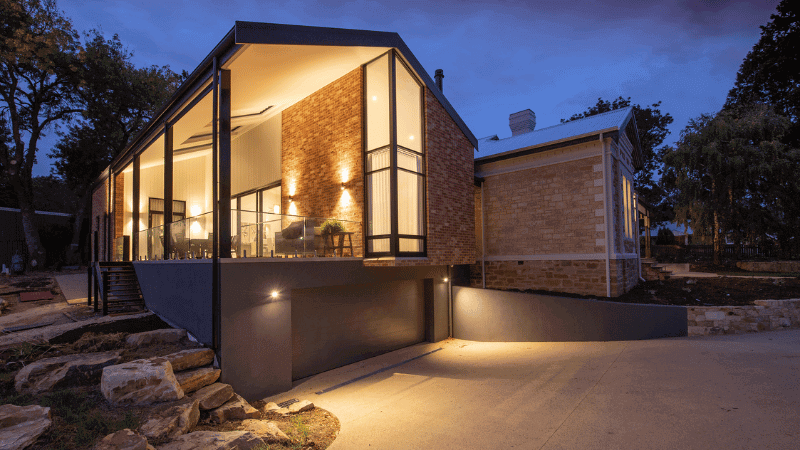

How To Get A Renovation Mortgage Loan (and Is It the Right Option for You?)

Whether you're a first-time buyer, a property developer, or you’ve inherited a property in desperate need of some love, a renovation mortgage loan can be a very helpful source of funds. theme-element?4393 When you find a property as a 'fixer-upper' with a view to either selling it on for...

Bridging Loan Interest Rates | From 0.53%

Bridging loan interest rates are currently available from 0.53% per month, but can reach as high as 0.78% per month and above for higher loan-to-value loans and more complex scenarios. The main driving factor for the rate you're eligible for is your loan-to-value, i.e., how much you're bo...

Bridging Finance: How Much Can I Borrow?

If you are looking for a bridging loan to give you the backing you need for a successful property purchase, renovation, or development, then one of the key questions that’s going to be on the forefront of your mind is how much you can borrow. Knowing your potential budget is key to the e...

Buy to Let Market Seeing Very Competitive Rates [February 2026]

The buy-to-let mortgage market continues to see very competitive rates in light of the Bank of England holding the base interest rate at 3.75%. Here's a snapshot of the best buy-to-let mortgage rates on the market today (switch to the buy to let tab): Landlord Sentiment: Still Positive But ...

BoE Holds Base Rate at 3.75% | What it Means for Your Mortgage [February 2026]

The Bank of England has voted to hold the base rate at 3.75% in February 2026, which keeps the rate at the lowest level it has been for 3 years. What does this mean your mortgage? During 2025, the Bank of England began easing monetary policy. In February last year, the base rate was reduced to 4.5%...

Base Rate Held at 3.75%: The Impact on Businesses [February 2026]

The Bank of England has held the base rate at 3.75%, and we explain what this means for your business. In December 2025, the Bank of England reduced the base rate to 3.75% in August, as part of an intentional strategy to reduce interest rates and tackle inflation. Rate setters have now decided...

NEWS: Are Mortgage Rates Going Down? [February 2026]

The Bank of England has voted to hold the base rate at 3.75% on 5th February 2026. This move is aimed at supporting economic stability and encouraging growth across the UK. Over the past 12 months, the Bank’s approach has been to steadily reduce the base rate in respo...

NEWS: 6x Salary Mortgages Now Available from Several Major UK Lenders

For many mortgage applicants, the upper limit on mortgages is the most frustrating part of the process. A typical lending cap of 4.5x income creates an artificial ceiling, especially for those in high-value areas such as London. While some lenders were offering 5.5x loan-to-income (LTI) mortgages t...

UK Mortgage Best Buys 2026: Compare Best Rates

Getting the best mortgage can save you thousands of pounds, with small changes in mortgage interest rates affecting your monthly payments by significant amounts and the right level of flexibility opening the door to better offers and easy transfers later on. But what are the best mortgages to get? ...

UK Property Market Forecast for 2026

As the new year settles in, buyers, sellers, and landlords are asking the same fundamental questions about the UK property market: Will UK house prices rise or fall in 2026? Where is the market strongest? What makes a good first-time buy? And where does it make sense to downsize for retire...

8 Best Places to Live in Spain as a British Expat

Getting away from the dreary British weather to seek a brighter future on Spanish shores sounds like a dream for many of us, and realising it is easier than you might believe. At Clifton Private Finance, we work with specialist financiers to get you the property-secured funding you need to buy a hou...

UK Property Market Review of 2025: Trends and Predictions for the New Year

As we move into 2026, the property market is looking positive if you’re a buyer. Lower mortgage rates and a wider range of mortgage deals are available, when compared to the last few years. And property prices seem to be softening, although this varies by region. Let’s look back at what...

Is Renovating Still Profitable in 2026?

The UK housing market has long been a haven for property renovators looking to turn a profit. But in 2026, with increased material costs and smaller profit margins, many are questioning if the renovation boom is finally slowing down. One of the biggest challenges facing renovators today is the...

The 9 Best Places to Live in the UK | 2026

Moving to the UK? We've put together a list of the best places to live in the UK if you're an expat or foreign national, rated for affordability, lifestyle, work opportunities and overall happiness. Moving to a new country is a monumental decision that opens the door to fresh experiences, dif...

9 Ways Manufacturing Companies Can Make the Most of Asset Finance

To stay ahead of the competition in the manufacturing industry requires significant investment. You need to take advantage of the latest technologies and ensure you’re running up-to-date machinery and equipment to maintain smooth operations. From vehicles used for delivery to CNC machines ess...

How to Secure a Land Mortgage in 2026

Ever thought about building your own home? A land mortgage is one way to purchase the land required to begin a self-build project. Let's run through everything you need to get a land mortgage in 2026 and how to make the process as efficient and affordable as possible. Key Takeaways Land mo...

7 Ways Agriculture Businesses Can Make the Most of Asset Finance

Asset finance is one of the more powerful financial tools in an agricultural company's toolbox. Designed as a method to offset capital investment through regular monthly payments, asset finance is extremely flexible and can be tailored to meet your business’s precise needs. The need to keep a...

Complete Guide to Fixed vs. Variable Rate Mortgages

Understanding how rates work when you get your mortgage or remortgage can save you hundreds (or even thousands) of pounds a year. However, because it’s couched in confusing terms and a little jargon, it’s understandable that many borrowers simply avoid the complexity. At Clifton Private...

HELOC (Home Equity Lines of Credit) | What You Should Know

One of the most powerful finance options available to homeowners in the UK is the HELOC, or Home Equity Line of Credit. A product that releases equity in your home in a flexible and manageable way, HELOCs have been common in the US for decades, but are only recently seeing popularity in the UK, whe...

Second Home Mortgages | Everything You Need to Know

What is a Second Home Mortgage? A second home mortgage is a specific type of mortgage used when you are looking for a second family home, perhaps a flat closer to the office, or a weekend home in the countryside. Second home mortgages are typically repayment mortgages, similar to yo...

Second Charge Mortgages for Buy to Lets

The UK buy-to-let market has undergone significant changes in recent years, with increased regulations and evolving requirements that landlords must meet to remain compliant. One area of growing importance is property energy efficiency. The UK government is pushing for higher Energy Performance Cert...

Auction Mortgages Explained: The Expert Guide to Fast Finance for Property Auctions

With more and more homes being sold at property auctions in the UK, understanding the process and how to get your mortgage in time to pay for one is an important part of the property market. Is there a specialist auction mortgage, and how do you get one? At Clifton Private Finance, we have the answe...

A Guide to Business Energy Management: How to Save Costs & Go Green

Energy costs are a major drain on cash flow for many SME. No business runs without energy, and in order to maintain high operability and smooth running, most companies are in a position where cutting back is challenging. As energy costs cut into margins, profits shrink and business operating c...

Mortgages For Dentists: How Much Can I Borrow?

The wrangling with HMRC about whether associate dentists are classified as self-employed has caused enormous uncertainty for young associates hoping to buy their first home, remortgage, or build some financial security by investing in a buy-to-let. However, many mortgage lenders understand the valu...

What Qualifies as a High Net Worth Mortgage?

Qualifying for a High Net Worth mortgage with your lender can make the difference in securing a loan at the size you need, getting a mortgage with a smaller deposit, or getting your ad hoc or complex income streams to count towards your application. You could also get preferential treatment from yo...

How to Get a Skilled Worker Mortgage

You may be wondering if you can buy a house in the UK on a skilled worker visa - and the answer is a resounding yes! There are some additional challenges, but it is very much possible with the right lender. A Skilled Worker Visa (also known as the Tier 2 visa before Decembe...

Contract Finance: A Guide for UK Businesses

Alongside invoice finance and PO finance, contract finance provides a way for businesses to gain capital and smooth cash flow in the early stages of a project, through a loan secured against the contract and the client’s creditworthiness. At Clifton Private Finance, we can help you structure ...

How to Compare Business Energy Suppliers

Energy costs are an ongoing concern for businesses, especially those with sizeable premises that generate large bills with day-to-day running. Ensuring you have the right partner for your energy supply can save you thousands of pounds per year, but with a complex market to understand, affected by ge...

Recourse vs. Non-Recourse Factoring: A UK Guide

Invoice factoring is a common and effective method of smoothing cash flow while waiting for income during the accounting strain of long payment terms. Designed as a method to release funds as soon as an invoice has been generated, factoring support is used by companies of all sizes, with revolving ...

Scottish Business Loans: A Guide to Funding & Finance

Scotland has one of the strongest business support landscapes in the UK. The Scottish Government and its agencies, including Scottish Enterprise, provide tangible opportunities both for start-ups and established growth businesses. Combined with the UK’s considerable marketplace for business l...

Autumn Budget Summary 2025: Biggest Impacts on the Property Market

After all the Budget rumours leaving the property market in suspense for months, in the end we found out by surprise what’s really coming for buyers and investors. Would the Chancellor scrap Stamp Duty, remove Capital Gains Tax relief on main homes, and introduce a Mansion Tax? A dramat...

Modern Method of Auction: A Complete Guide

With the ease of an online service and the thrill of an auction, the modern method of auction (MMoA) provides property buyers with a way to access a wider spread of properties. Importantly, MMoA sidesteps the biggest problem of a traditional auction process for mortgage users - the 28 day payment wi...

Additional Borrowing on Mortgage: Further Advance + 5 Alternative Ways

When looking to raise extra capital against your property equity, the most common ways are to either remortgage, or take out a secondary homeowner loan for the extra funds. However, snuck somewhere in the middle of these two products lies the further advance, a top up of additional borrowing r...

Autumn Budget 2025 Predictions for Landlords and Investors

With the Autumn Budget looming and the chancellor under pressure to raise revenue, eyes are particularly focused on the property sector and how potential changes will impact both mortgages and bridging finance in the UK. Discussions and predictions over potential changes to how properties are taxed...

Autumn Budget 2025 Predictions for Business Finance

The Autumn Budget 2025 comes off the back of the first fall in inflation for several months, news that must buoy the Chancellor’s office even though it’s still well above the 2% Bank of England's target. It is a budget that sees UK business leaders and market lenders cautious, delaying ...

How to Refinance Business Loans (and Why You Should)

Too often, as companies grow, they add business debt obligations that can snowball out of control if not managed properly. The fact that you can refinance business loans is overlooked, rather than considered as a strategic option. Facilities taken at startup, or during periods of rapid growth, may ...

Bridging Loan for Buy to Let: How Investors Use Short-Term Finance to Grow Portfolios

For many property developers and investors, using a bridging loan to renovate a buy-to-let property is an exciting opportunity to boost the market value of the property and maximise the rental yield for the strongest possible return on investment. Mortgage regulations are typically too strict and s...

How To Get A Mortgage On A UK Property If You Live In Australia

Buying property in the UK offers both a comfortable investment and a way to maintain ties to the UK should you plan to move here in the future. However, before you start to look at potential purchases, it's important to understand if you can get a UK mortgage when you live in Australia. Whether you...

Pensioner Mortgages: How to Unlock Borrowing Power in Retirement

It’s a common misconception that once you stop working, you are effectively locked out of mortgages - thankfully, that’s not the case. Increasingly, lenders are becoming more open to borrowing during retirement, using your pension and other alternative income to calculate affordability. ...

How to Secure A Rural Property Mortgage

When many of us think of the word rural, we envisage sprawling countryside, tight pot-holed lanes, and stone cottages with chickens and pigs in the garden, but when it comes to property finance, rural can encompass a wider range of property types that are outside of main towns and cities. For a len...

How Much Does A House Extension Cost? (and How to Finance It)

Adding an extension is one of the best investments in your home that you can make. Well planned and efficiently project managed, expanding the kitchen, adapting the loft into an additional bedroom, or building a better bathroom can all add significant value to the property, making the outlay an effe...

Everything You Need to Know About A Flexible Mortgage

Many people see mortgages as a rigid product - a long-term loan set to 25 years with little room for adjustment. The truth is very different. At Clifton Private Finance, we work with the full spectrum of banks and specialist lenders to offer our customers the greatest level of flexibility when choo...

Mortgages on Maternity or Paternity Leave

Growing your family often makes you think hard about your finances. Having a baby on the way can bring about thoughts regarding your home situation, and leads neatly into the idea of moving up the property ladder - but how does maternity or paternity leave affect your mortgage chances? At Clifton P...

Can I Borrow Against a Property With No Mortgage?

If you own your property outright, you might wonder if it's possible to secure a loan against a property with no mortgage. You'll be pleased to know that it is possible and a few options exist. So what are they? Many homeowners look to access cash to help get through extraordinary circumstances. Fr...

Guide to the UK's Specialist Mortgage Lenders

At Clifton Private Finance, we work with the wide marketplace of UK mortgage lenders - but what does that mean? Is there any difference between a high street bank and one of the so-called ‘specialist mortgage lenders’? Well, actually, yes there is... In this guide we take a deep dive in...

Can I Remortgage to Buy Another Property?

Yes, it is possible to remortgage to buy another property. In fact, remortgaging your current home is a common method of raising funds to purchase another property. If you’ve been repaying your mortgage for many years, you’ll have built up a chunk of equity in your home that you can&rsq...

Seafarer UK Mortgages: The Ultimate Guide

Many seafarers can qualify for standard UK mortgage rates if they claim the Seafarers Earnings Deduction (SED) and maintain ties to the UK. However, issues like fluctuating exchange rates, offshore banking, and proving your affordability can complicate the process. It isn't straightforward to appl...

Capital Expenditure (CAPEX) Loans Explained

Finding the business capital for long-term investments often requires using external funding. While many businesses naturally reach to traditional loans to fund significant purchases, preserving their cash flow and spreading the cost of investment, these can be somewhat inflexible, providing a sing...

How to Get a Limited Company Buy to Let Mortgage

It has become more challenging to turn a profit as a landlord in recent years, but using a limited company buy to let mortgage could help you save and boost your margins. Here's how you could get one. Whether you're buying your first investment property or are an established private landl...

How Do Joint Mortgages Work?

A joint mortgage is when two more people borrow to buy a house together, sharing the responsibility for the loan and its repayments alongside the shared ownership of the property. For decades it has been the most common way for married couples or those in a civil partnership to buy a home, but can ...

Interest Only Mortgages for Older Borrowers (70+)

Securing a mortgage when you are an older borrower has been an ongoing hurdle for many. Home remortgaging when you are over 70 is out of reach with standard banking structures. High street banks typically set an upper age limit for repayment at 75, and offset that with a minimum 5-year term, making ...

NEWS: First-Time Buyer Repayments 20% Lower than Rent

A recent Zoopla report has revealed that first-time buyer mortgage repayments in the UK are 20% lower than the cost of rent. The findings come as house price growth has stalled, while rents continue to rise (up 32% over the last five years). Zoopla analysed the cost of renting vs the cost of buying...

How To Get A UK Expat Buy To Let Mortgage

An expat buy-to-let (BTL) mortgage is an ideal financial product for nationals currently living and working in another country. At Clifton Private Finance, we specialise in matching expat clients with understanding lenders, achieving BTL mortgages with low rates and essential flexibility. Living ou...

NEWS: Investing in London Property | Is Now a Good Time?

London’s once red-hot property market has cooled significantly in recent years, leaving investors wondering whether now is the right time to buy. The latest data suggests a mixed picture: while house price growth has slowed and profits for sellers have halved since 2016, upcoming shifts in mo...

The Best Areas in Prime Central London for Property Investment

Prime Central London's allure as an investment destination is undeniable. While property values in the city centre are among the highest in the world, the area's enduring appeal, limited supply, and strong demand from affluent buyers contribute to its resilience and potential for capital appreciatio...

NEWS: Is Investing in a Buy to Let Still Worth it in 2025?

Investing in a buy to let property has the potential to generate high ROI through both rental income and building equity, but amid the current costs of owning a property, many are asking if being a landlord is still worth it. A number of landlords are expressing dissatisfaction with slim profits an...

The 10 Best Places to Invest in Property in the UK in 2025

Property investment continues to be one of the most popular strategies for building long-term wealth in the UK. With average rental yields ranging between 4.51% and 6.22%, choosing the right location is crucial for maximising returns. According to the latest analysis from Joseph Mews, the best prop...

Your Bridging Loan Exit Strategy

Designed as a powerful short-term form of finance for property purchases and renovations, bridging finance is an excellent way to get significant funding quickly and efficiently - but it relies on a well-developed exit strategy. At Clifton Private Finance, as specialists in both bridging and mortga...

Aged 70 Plus? How to Get a Mortgage

The mortgage landscape for retirees may not look quite the same as it does for people in their 20s, 30s, and 40s, but that doesn’t mean financial solutions for people in their 70s are limited. With a range of products designed to help homeowners unlock the capital you have tied up in your h...

Is Equity Release Tax Free?

Is Equity Release Tax-Free? The simple answer is yes, equity release is tax-free, as you don't need to pay income or capital gains tax when you receive equity release funds. But why is this the case, and what other tax benefits can be drawn through the use of equity release? At Clifton Private Fin...

How Do Buy-to-Let Mortgages Work?

Buy-to-Let (BTL) mortgages are the staple financial product for landlords across the UK. When tailored well to your needs, a BTL mortgage provides an affordable loan that’s perfectly suited for property investment, with low monthly payments, clearly-structured repayments, and ongoing flexibili...

Can I Get a Mortgage for 5 or 6 Times My Salary?

Is it possible to borrow more than five times your salary for a mortgage? The short answer is yes, you can get a five-times-salary mortgage. However, there are rules that mortgage lenders have to follow. Amidst high interest rates and strong demand for property across the UK market, mortgage afford...

Fractional CFOs: When and Why to Bring on Board

Managing your business finances becomes increasingly complex as the company grows. Tasks that were once easily shared between business owner and accountant turn into time-consuming projects that need dedication - ideally from someone with a precision focus on business financials. Businesses outgrow...

We Buy Any House Services: Pros, Cons, and 5 Alternatives

At Clifton Private Finance, we often work with clients who are looking to release the equity in their homes. The simplest way to achieve this is to sell your property outright. We Buy Any House (WBAH) type businesses represent a fast and efficient way to sell your house, offering quick cash in ...

How to Get a Debt Consolidation Mortgage - 5 Best Options

Financial difficulties can happen to anyone, especially in uncertain economic times. It is all-too easy for life to steamroll us a little, and for more important things to draw your attention away from prudent money management for a while. You may have been sticking your head in the sand a little, ...

How to Use Bridging Finance to Buy a House in London

Buying property in London is competitive. The market moves rapidly, fuelling a feeling of ‘act now or lose out’ that can ruin many house-buying plans. While mortgages provide the perfect long-term answer to funding a property purchase, they are relatively slow to set up, come with strin...

NEWS: First Time Buyers Dominating London Market

London is seeing an increase in purchasing activity from first-time buyers despite high cost-of-living and homebuying costs. Here's how you can navigate the evolving London market. Written by Luka Ball According to new data, in 2023, London saw 181,000 first-time buyers purchase homes. This m...

How To Invest in Prime Central London Property

The PCL property market has demonstrated remarkable resilience amidst economic challenges, positioning itself for a promising outlook in 2024. As the UK economy is expected to grow, putting the property market on a more optimistic track, the PCL sector has already showcased its strength. In 2023, ...

6 Best Places to Live in London - The Full Guide

London is one of the most popular places to live in the world. With access to globally renowned educational facilities and a thriving jobs market, London is naturally the most popular city in Britain to settle in. According to the UN, the UK is one of the top 20 happiest places in the world. If you...

Buying Property in London as a US Citizen: 9 Things You Need to Know

If you're interested in buying property in London as a US citizen, you're not alone. And if you're wondering how easy it is to get a UK mortgage as a non-UK national, the good news is there are plenty of specialist lenders who will be willing to make you an offer. The UK property market is the...

NEWS: The London Boroughs Climbing in Value Despite Property Slump

London’s property market shows a tale of two cities in 2025, with some areas witnessing unprecedented growth while others reveal steep declines. Against a backdrop of economic uncertainty, the market is offering unique opportunities for buyers, driven by notable price adjustments, increased s...

Smart P&L Management for Modern Corporations

Reacting with agility to changes in markets and the wider economy is vital for high-turnover businesses. Changes in the wider financial landscape can put unexpected pressure on well-established margins, eating into profit and eroding the business’s capital headroom. Pre-emptive and smart prof...

Payment Term Lifetime Mortgages: Pros and Cons Explored

Payment Term Lifetime Mortgages (PTLM) offer a comfortable middle ground between the heavier interest of a lifetime mortgage and the risks associated with an interest-only mortgage, offering the security benefits of the first combined with the interest management of the second. Equity release ...

How to Release Equity for Home Improvements

When you are a homeowner, you soon realise that there’s a financial impact beyond simply paying for the mortgage. While you are repaying the loan you used to buy your home, you will also need to deal with keeping that house in top condition. Many home renovations are minor enough that they ca...

14 Reasons to Remortgage | Options Explained

Often, your home is your largest financial asset and the loan secured by it - your mortgage - your greatest financial obligation. It only makes sense, therefore, that you have a good understanding of your mortgage and keep a vigilant eye on it. This means being open to remortgaging. Remortgaging ...

How to Get Finance to Buy an Uninhabitable Property

Can you get a mortgage on an uninhabitable property? Before you start looking for finance, there are a few things you should know. It’s the bargain of the century - a wreck which could be your dream home. Or it’s a profitable "doer-upper" which you could renovate and rent...

9 Ways To Increase EBITDA And Why It Matters

EBITDA - Earnings Before Interest, Taxes, Depreciation, and Amortisation - is a global financial standard measure of your business’s performance, providing a clear perspective of the financial situation before accounting obligations complicate the picture. For larger businesses and corporatio...

8 Advantages and Disadvantages of Invoice Discounting (and Is It Right for Your Business?)

There are clear advantages and disadvantages to invoice discounting as a form of business finance. If your business needs access to funds, it’s important to understand these pros and cons so you make the best decision on the type of finance you pursue. But what exactly does invoice disco...

How to Remortgage a Buy to Let Portfolio (The Right Way)

Changes to tax and regulations mean that landlords' finance needs to work harder for them to ensure the profitability of their rental property holdings. Good returns aren't only available to those who "stay small". But the new financial landscape does mean that investment property owners can't affo...

Mortgages for Doctors - How You Could Borrow More

Mortgages for doctors are not always as straightforward as you may expect, especially if you want to push the limits of your borrowing in terms of income multiples and loan-to-values... But with the help of a specialist broker, there are some highly favourable terms available to you. We&rsqu...

Yacht crew mortgage: How to get finance for a UK property

When you work at sea, buying property at home in the UK can seem difficult, with one key challenge being identifying where it is you live. You consider the UK to be your home, but mortgage lenders want to class you as an expat, leading to higher rates and complex mortgage applications. With tax-fre...

How To Get a Professional Mortgage (& Borrow More)

As a professional with hard-won qualifications and a structured career path, you could be eligible for a professional mortgage to match. There are 8 ways you could be entitled to a better mortgage as a professional within an established industry. Some UK mortgage lenders offer prof...

How Much Does a Bridging Loan Cost?

The costs associated with bridging loans typically reach 1-2% of your loan size, charged as an arrangement fee by your lender. These costs come through several fees and admin charges. You also usually pay: A monthly interest rate Valuation or survey fees Legal fees Br...

HMO Mortgages: Lender Requirements, Rates and More

HMOs are still proving to be a lucrative investment today, but if you're looking to secure finance, expect different lending options for an HMO mortgage. The ROI returns can be impressive, but only a few specialised intermediary-only lenders will fund a foray into the multi-let market. If you've p...

How To Refinance a Mortgage or Property in the UK

It's common to refinance a property during your mortgage term. Over time, interest rates will fluctuate, and you will build up equity in your property, allowing you to switch to more advantageous products. The average mortgage term is 30 years, but you won't typically be on the same mortgage deal f...

Remortgage for Home Improvements [+4 Alternatives]

When it comes to home improvement loans, a remortgage is often the top consideration - but is it your best option? At Clifton Private Finance, we work with a wide range of finance options to ensure that you get the capital you need with the best rates and most flexible terms. If you are looking to...

9 Best Types of Home Improvement Loans Compared

Did you know that there's a range of different types of home improvement loans available in the UK - not just personal loans and remortgaging? We explain how each loan works and what circumstances they could be suitable for. You might be giving your home a total makeover or making c...

Understanding Short Lease Mortgages - The Complete Guide

If you're looking to buy or remortgage a property with a short lease remaining, you likely have questions about eligibility and process. You’ll want to know exactly how short lease mortgages work, what lease extensions are, and what the potential risks and concerns a short lease mortgage may b...

Buying Property in the US as a UK Citizen

Dreaming of owning a property in the United States? For UK citizens, investing in the US real estate market is an exciting but intricate endeavour. This guide will equip you with requirements, process, and essential tips to help you make your American real estate dream a reality. Note: At Clifto...

How to Get a Joint Mortgage with a Non-UK National Partner or Spouse

Getting a joint mortgage where one partner is not a UK national can be challenging. We have a strong track record in matching international clients with the lending they need. Buying a home together is an exciting milestone, but for couples where one partner is not a UK national, securing a joint m...

What Happens to Your Mortgage if You Move Abroad

If you’re a homeowner planning to move abroad, you’ll be pleased to know that your mortgage won’t be affected significantly if you decide to leave the country. However, you will need to let your lender know and apply for a consent-to-let if you plan on renting your home out while ...

A Guide To Offset Mortgages: Are They Still A Good Idea?

If you are thinking of remortgaging and have savings in the bank, it may make sense to consider an offset mortgage: a lesser-known product that could help you save money on your repayments. Anyone with a considerable amount of savings may be well served by an offset mortgage, which can result in lo...

How Does Equity Release Work When You Die?

Equity release represents a range of arrangements that allow you to leverage your home to obtain funds while still living in it. In the UK, it includes such products as lifetime mortgages, retirement interest-only (RIO) mortgages, home reversion plans, and HELOC (Home Equity Lines of...

Can You Get a Mortgage for a Barn Conversion? Best Options

Barn conversions have been a popular way to create stunning rural homes full of character for many years, but as with any conversion of a non-residential building, funding can be an issue. You may not be able to get a mortgage for these builds, but a bridging loan could finance your barn conversion ...

How To Remortgage A Buy To Let Property

You may be considering if the time is right to remortgage your buy to let property. You could find a better deal or release some equity for further property investment. Here we explore why you might want to remortgage a buy-to-let property (BTL), what considerations you need to make,...

Let-to-Buy Mortgage | What You Should Know

If you are looking to rent out your home and buy another property to live in, then a let-to-buy mortgage is the perfect product. Designed to switch your mortgage from a standard residential mortgage to a landlord-appropriate buy-to-let, and allowing you to obtain a residential mortgage for a new pr...