Categories

NEWS: How Will a Labour Government Affect the UK Property Market?

With Labour in government for the first time in nearly 15 years, many Britons are wondering how this will affect the property market.

Written by Luka Ball

Historically, general elections have not had extreme impacts on the housing market, but a clear electoral mandate can boost buying confidence. Issues raised during and after an election can sway consumption trends, impacting spending and saving behaviour. Election outcomes can also shift expectations about inflation and interest rates, influencing borrowing costs and investment.

Furthermore, international perceptions of the UK economy, shaped by political stability and economic policies, can affect foreign investment and trade relations. The overall impact of a general election on the UK economy hinges on the winning party's policies, post-election political stability, and businesses' and consumers' reactions to these changes.

Data shows that in the week leading up to the recent election, 45,724 homes were listed for sale in Great Britain. This number rose by over 3000 in the week following the election, marking a 6% increase and a combined home value of nearly £13.8 billion. The Yorkshire & Humber region experienced the most significant post-election surge with a 10.2% rise in new listings, followed by the South East, London, the South West, West Midlands, and Scotland.

Looking to Compare Mortgages?

The Royal Institution of Chartered Surveyors (RICS) UK residential survey for June reflected cautious optimism. Although market activity remained subdued, potential easing of monetary policy by the Bank of England and a clear electoral mandate placing housing high on the political agenda could support a recovery.

Prior to the election, the housing market struggled with falling sales, declining prices, and fewer new sellers. Chancellor Rachel Reeves emphasised the government's focus on increasing homeownership and the need for affordable housing, including social rent, highlighting the crucial role of the private sector.

Despite these challenges, there are signs of market recovery. HMRC data revealed a fourth consecutive monthly rise in house sales in April, with a 5% increase to 90,430 transactions. This follows a slight increase in mortgage rates earlier in the year, which temporarily slowed the market.

A study by the Institute for Fiscal Studies (IFS) reveals that average incomes grew by just 6% from 2009-10 to 2022-23, a stark contrast to the 30% growth expected before the financial collapse. This stagnation poses additional challenges for homeowners and prospective buyers.

Labour’s election manifesto proposed a 'Freedom to Buy' scheme aimed at helping 80,000 young people onto the housing ladder over the next five years. This scheme would make the current mortgage guarantee scheme permanent, incentivising lenders to offer high loan-to-value mortgages by acting as a guarantor for those unable to afford large deposits.

Labour has also pledged to reduce the first-time buyer stamp duty threshold from £425,000 to £300,000 and to raise stamp duty on residential property purchases by non-UK residents by 1%. Additionally, the party plans to continue scrapping non-dom status, which could deter foreign investment but potentially boost domestic supply and demand.

The new government aims to build 1.5 million new homes, a goal that faces significant challenges, including green belt issues and stringent planning departments. However, success will require substantial resources, investment, and cooperation from local authorities.

Read blog: What Proof of Income Do I Need to Get a Mortgage? & How to Find & Download Tax Documents for a UK Mortgage

How Will the Election Affect the Buy to Let Property Market?

Slow growth in the rental market has led many landlords to question the viability of buy-to-let investments. Many of them are apprehensive of what's to come with the new government. It's possible the buy-to-let market could see volatility under Labour.

Traditionally, the Conservatives have advocated for the property investors in attempt to stimulate growth in the property market, however in the past two years, high borrowing costs and regulatory changes have negatively impacted the rental sector. In the past, Labour have championed stricter regulations on private renting in attempt to safeguard tenants, but Keir Starmer's party's more centrist policies don't necessaily mean the squeeze will tighten on landlords.

However, the Renters Reform Bill, aimed at abolishing Section 21 'no-fault' evictions, was progressing through parliament before the election. Landlords are critical of Labour's manifesto promise to "immediately abolish" no-fault evictions.

Despite these challenges, there are signs of resilience in the housing market. Nationwide reported a modest bounce back in UK house prices at the end of May, following two months of declines. The market's ability to withstand various pressures will be crucial as the new government’s policies take effect.

House Prices Have Grown More Under Labour in the Past

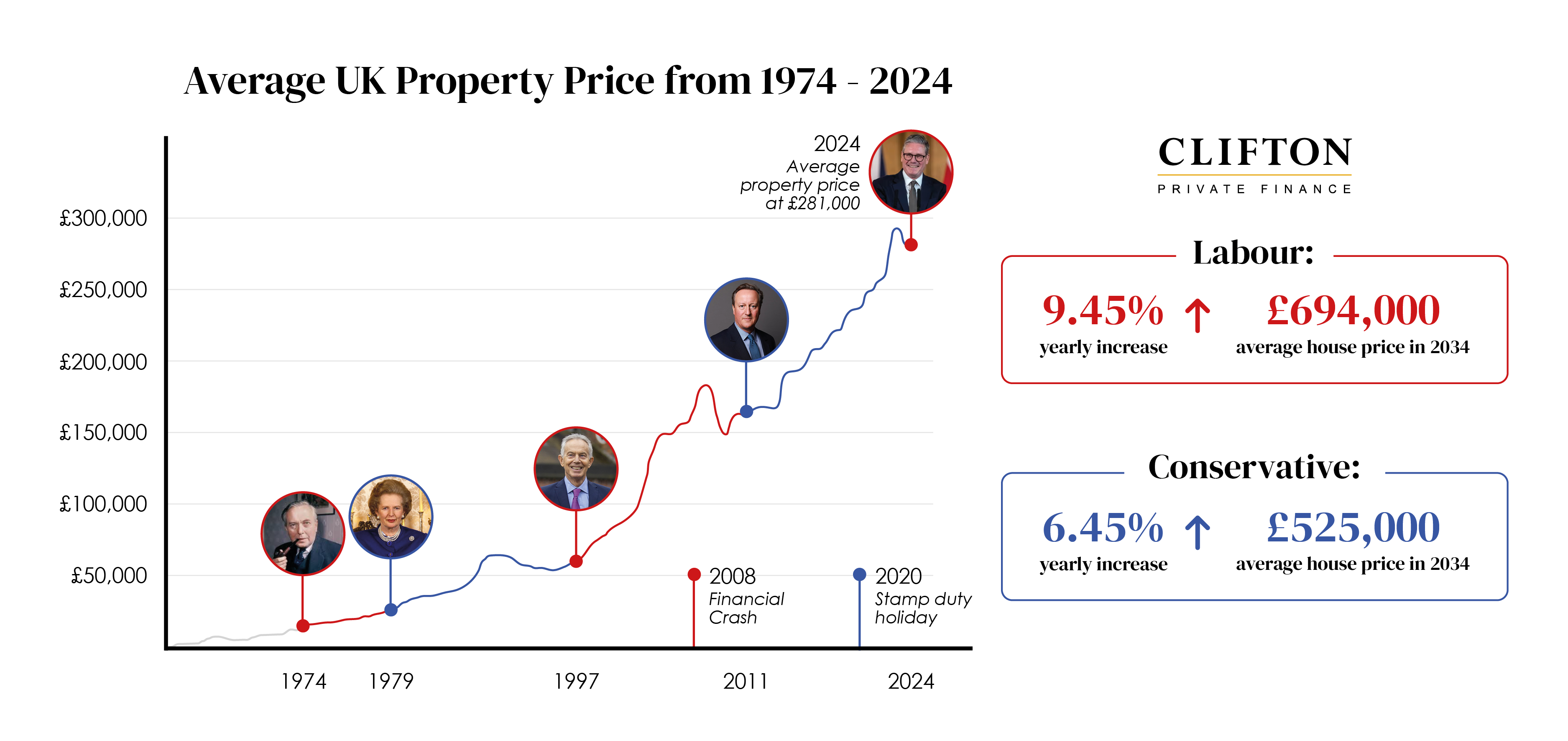

Our new research shows that in the past 50 years, house prices have grown 3% more under a Labour government under the Conservatives.

Key Findings:

-

House prices have grown more under a Labour government than under Tory leadership over the last 50 years.

-

Average annual house price growth under Labour since 1954: 9.45%

-

Average annual house price growth under Conservatives: 6.45%

-

Labour has a higher growth rate despite Labour being in power during the 08 financial crash, and the Tories being in power during the Stamp Duty Tax holiday in 2020 that caused a small house price boom.

The study, which analysed data from the Nationwide House Price Index since 1954, compared property price trends with political leadership over the same period. Labour governed for 19 of the 50 yearsanalysed, while the Conservatives held power for 31 years.

Since 1954, we have seen the average property price increase from £1,853 to £281,000.

Want to know more? Read our article on house price growth to get access to the full dataset.

What Do the Experts Say?

Alex Morris

Private Client Adviser

George Abouzolof

Senior Finance Broker CeMAP

It boils down to consumer confidence - if there is little to no perception of trust in a party’s leadership, this affects exchange rates and the economy's overall performance.

Choosing to announce the general election just after the inflation numbers were released was certainly a strategic move from Rishi Sunak, and the economy is likely to play a large role in this year’s election debates.

And how about our readers?

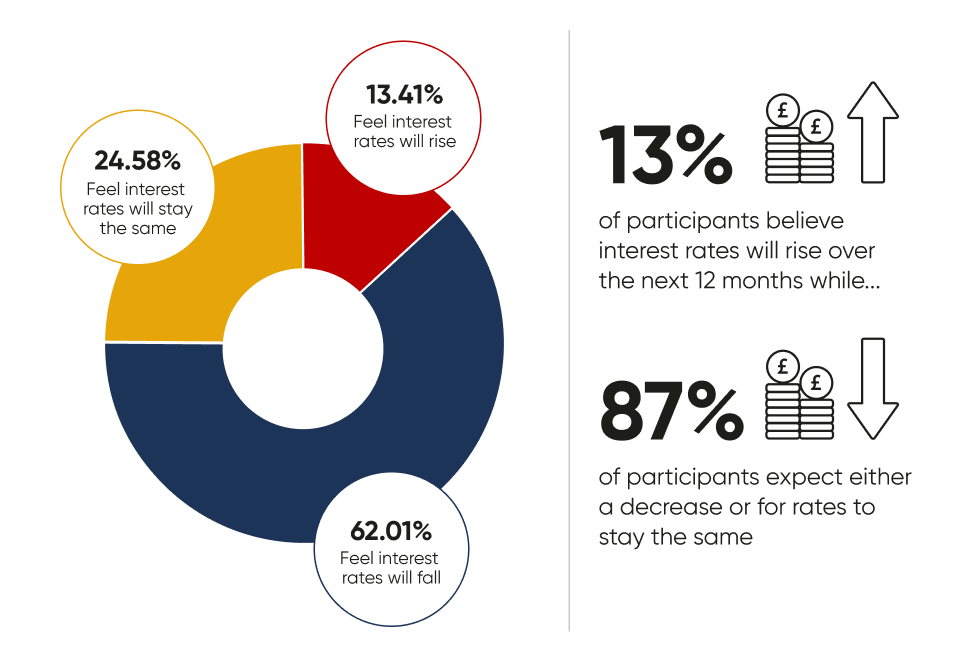

Just 13% of participants believe interest rates will rise over the next 12 months, while 87% expect either a decrease or for rates to stay the same.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

Read our full survey results »

See the latest market news below.

Where Are the Most Affordable Places in the UK to Buy a Home?

House prices are rising, but not as rapidly as they were before 2022.

In 2024, we did see a modest rise in house prices, but since the budget, this has come down slightly. The Bank of England base rate has dropped, but mortgage deals don’t seem to be moving in response to the Autumn Budget, which has since been widely considered inflationary.

As the housing market begins to recover from the past four years of economic turbulence, there seems to be a case of push and pull between house prices and interest rates restricting affordability.

Limited affordability has caused a visible divide between the UK’s most and least affordable housing. And unfortunately, in more expensive areas, first time buyers aren’t getting to enjoy much of a drop in house prices because the difference is made up by high interest rates and less favourable mortgage deals.

Mortgage rates have come down slightly from their 15-year high, and while the housing market does seem to be on the mend, it’s still not the easiest time to buy property for first-time buyers and investors alike.

For buy to let investors, regulations have gotten stricter since 2022, and high mortgage rates have thinned profit margins, making owning a standard buy to let a trickier affair than a decade ago.

While house prices have dropped slightly due to lack of affordability across London and the rest of the South, this isn't the case in other regions.

But this isn't the case everywhere in the UK. The North of England has seen entirely different purchasing behaviour to the South since the early 2000s. In select areas, particularly Yorkshire, North Lincolnshire and Durham, you can still easily buy a property for under £100,000.

Due to affordable housing and cheaper living costs in these areas, most of Northern England and Scotland have been resistant to the housing slump that the rest of the UK has experienced in response to high mortgage rates. The property market in these regions has remained robust and has seen growth throughout 2024.

There's certainly hope, both for property investors and those looking to get on the housing ladder. If you're looking to invest in a buy to let in 2024, it may be worth looking in affordable areas with a consistent rental demand, such as university towns or areas close to large employers. Property hotspots like these are still reaping generous rental yields while the rest of the country is seeing slow growth.

For first-time buyers, house prices coming down significantly could make it much easier for them to get on the housing ladder, but in many cases, house prices going up is beneficial for those using equity in their homes to make another purchase.

Looking for a Mortgage in 2024?

It can be difficult to understand what the right mortgage option is. We can help you compare mortgage products and their cost to find the best deal based on your specific situation from a wide range of lenders nationwide.

Expert mortgage advisors have their finger on the pulse of the latest mortgage market news. Whether you're a first-time buyer or looking to refinance or invest in a BTL, we can help you understand your mortgage options so you feel confident you're making the right choice.

To see what we can do for you, give us a call at 0203 900 4322 or book a free consultation below.