Categories

RESEARCH: House Prices Grow More Under Labour Than Tories Historically

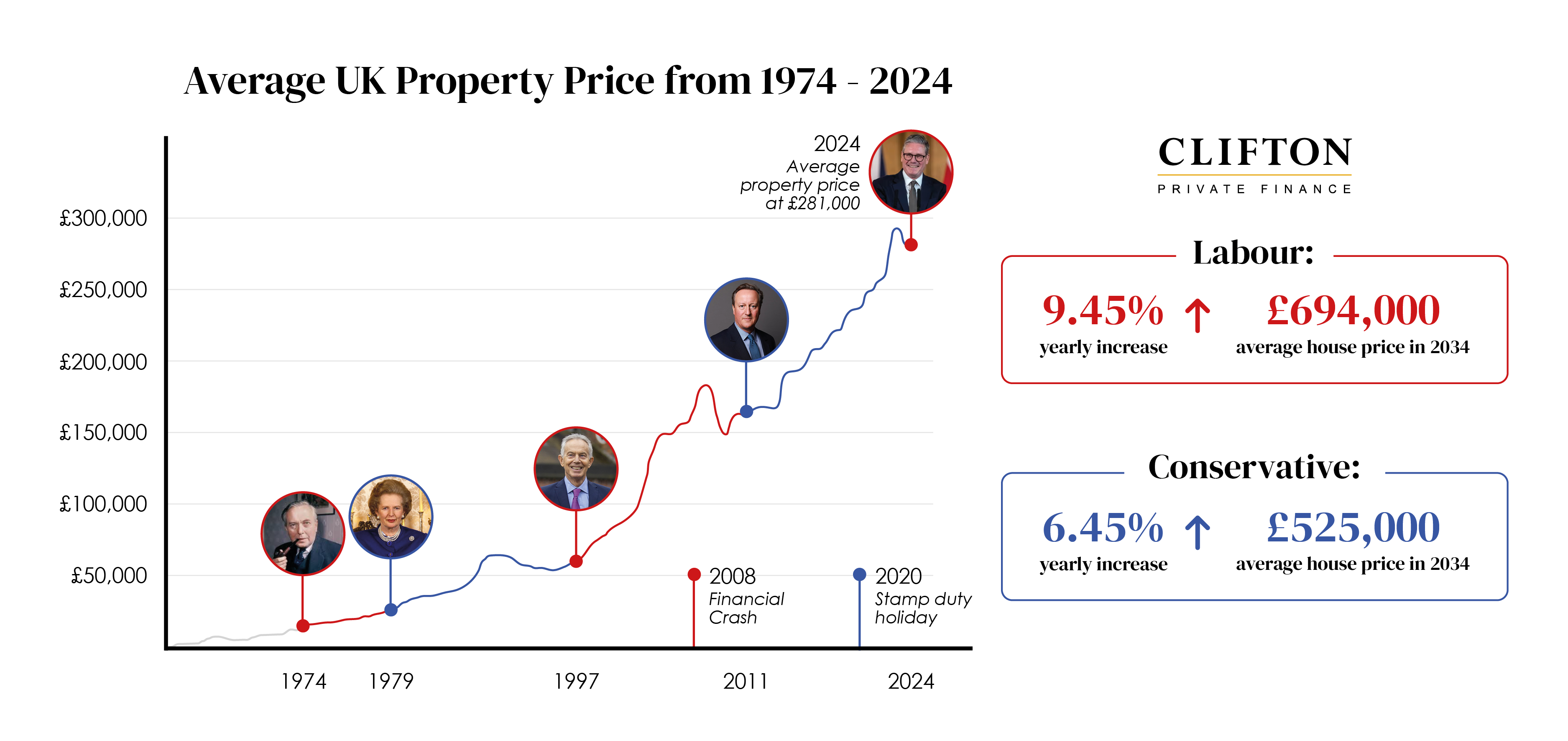

Bristol, 29/07/2024 - New research from Clifton Private Finance, a leading property finance brokerage, reveals how property prices have risen under the different political parties in the UK.

Key Findings:

-

House prices have grown more under a Labour government than under Tory leadership over the last 50 years.

-

Average annual house price growth under Labour since 1954: 9.45%

-

Average annual house price growth under Conservatives: 6.45%

-

Labour has a higher growth rate despite Labour being in power during the 08 financial crash, and the Tories being in power during the Stamp Duty Tax holiday in 2020 that caused a small house price boom.

The study, which analysed data from the Nationwide House Price Index since 1954, compared property price trends with political leadership over the same period. Labour governed for 19 of the 50 yearsanalysed, while the Conservatives held power for 31 years.

Since 1954, we have seen the average property price increase from £1,853 to £281,000.

Future Projections

Clifton Private Finance projects potential average property values by 2034 assuming these historical growth rates*:

-

Using Labour's 9.45% growth rate: approximately £690,000

-

Using Conservative's 6.45% growth rate: approximately £520,000

-

Using a middle-ground 7.95% growth rate: approximately £600,000

*Pervious performance of the property market does not guarantee future returns

"This research provides an interesting historical perspective on the relationship between political leadership and property market performance," said Sam Hodgson, Editor at Clifton Private Finance.

"While past data doesn't guarantee future performance, these findings offer valuable insights for property investors and homeowners alike."

The Mortgage Market Since the Election

Alex Morris

Private Client Adviser

George Abouzolof

Senior Finance Broker CeMAP

It boils down to consumer confidence - if there is little to no perception of trust in a party’s leadership, this affects exchange rates and the economy's overall performance.

Choosing to announce the general election just after the inflation numbers were released was certainly a strategic move from Rishi Sunak, and the economy is likely to play a large role in this year’s election debates.

For more information about this research or to speak with a Clifton Private Finance representative, please contact:

Helpdesk@cliftonpf.co.uk

About Clifton Private Finance: Clifton Private Finance is an award-winning, independent property and business finance brokerage based in Bristol.