Categories

How to Get an Optometrist Mortgage

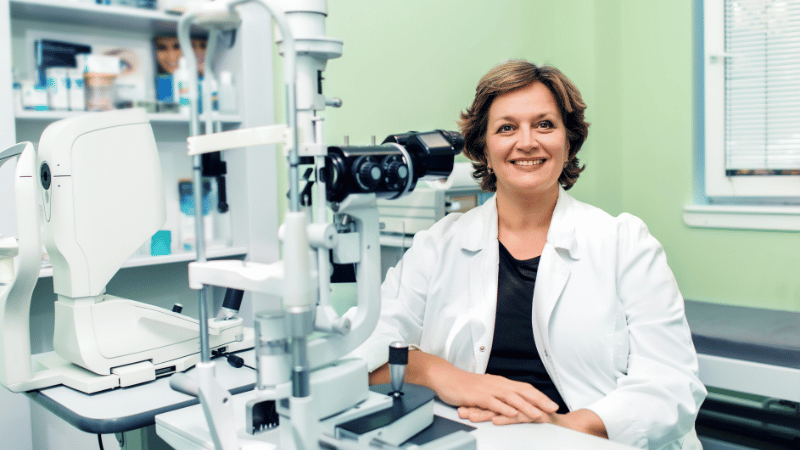

Are you an optometrist looking to secure a mortgage in the UK? Your career offers unique advantages when it comes to property financing.

Whether you're aiming to buy a home or invest in your own practice, understanding how to leverage your professional status for a mortgage is crucial.

Let's explore how your profession can open doors to enhanced mortgage opportunities, allowing you to maximise your financial potential and achieve your property goals.

Professional Mortgages for Optometrists

Eligibility Criteria for Optometrist Mortgages

Types of Mortgages and Loans for Optometrists

How Professional Mortgages Compare

Additional Benefits of Professional Mortgages

Starting or Buying an Optometry Practice

Application Process for Mortgages

Market Trends & Alternative Financing Options

Professional Mortgages for Optometrists

As an optometrist, you're part of a select group of healthcare professionals who may qualify for specialised mortgage products. These 'professional mortgages' recognise the stability and earning potential of your career.

Benefits for Optometrists

Optometrists often enjoy higher income multiples. While standard mortgages typically offer 4-4.5 times your annual income, you might access up to 5-6 times your salary.

Lenders view optometrists as low-risk borrowers. This can translate into more favourable interest rates, potentially saving you thousands over the life of your mortgage. Additionally, some lenders offer more lenient terms for optometrists. This might include considering future earning potential or being more accommodating with contract work.

Eligibility Criteria for Optometrist Mortgages

To qualify for these enhanced terms, you'll typically need to:

- Be fully qualified and registered as an optometrist with the General Optical Council (GOC)

- Provide proof of income and employment status

- Have a clean credit history

Some lenders may also consider trainee optometrists, recognising the structured career progression in your field. They'll consider future earning potential, though terms may be more favourable once you're fully qualified.

Want to know how much you could borrow? Use our mortgage calculator below:

Types of Mortgages and Loans for Optometrists

- Residential Mortgages: For purchasing your primary residence. As an optometrist, you may access higher loan-to-value ratios and better rates.

- Buy-to-Let Mortgages: If you're looking to invest in property, your professional status could help you secure more favourable terms.

- Commercial Mortgages: These are used to acquire premises for an optometry practice. For instance, if you're looking to buy a £500,000 property for your practice, you might be able to borrow up to 70-75% of the value, meaning you'd need a deposit of £125,000-£150,000.

- Practice Loans: Specifically designed for optometrists to buy existing practices or invest in new equipment. For example, a £200,000 loan could help you purchase an established practice or upgrade your diagnostic equipment.

- Jigsaw Funding: This involves combining different types of financing. You might use a commercial mortgage for 70% of a practice purchase, a business loan for 20%, and personal funds for the remaining 10%.

How Professional Mortgages Compare

Standard Mortgages

- Income Multiple: Typically 4-4.5 times annual income

- Interest Rate: Generally aligned with market average

- Borrowing Limit: Based primarily on current income

Professional Mortgages for Optometrists

- Income Multiple: Up to 5-6 times annual income

- Interest Rate: Often below market average

- Borrowing Limit: May consider future earning potential

Additional Benefits of Professional Mortgages

- Higher Loan-to-Value (LTV): Some lenders offer higher LTV ratios, meaning you might need a smaller deposit.

- Flexible Criteria: Lenders may consider factors like future income potential and career stability.

- Additional Perks: You might receive benefits like discounted fees or cashback on completion.

Starting or Buying an Optometry Practice

- Warm Start: Buying an existing practice can provide immediate cash flow. For instance, a practice with an annual turnover of £500,000 might be valued at 1-1.5 times its turnover, costing £500,000-£750,000.

- Cold Start: Starting from scratch requires more capital but allows you to build your ideal practice. Initial costs could range from £100,000 to £300,000, depending on location and equipment needs.

- Due Diligence: When buying a practice, thoroughly research patient numbers, NHS contracts, and potential for growth. For example, a practice with 5,000 active patients and a mix of NHS and private work might be more valuable than one with 3,000 patients and only NHS work.

Finding the Right Lender

Many UK lenders, including high-street banks, offer mortgages tailored towards healthcare professionals, including optometrists.

When comparing lenders, consider:

- Interest rates: Both initial rates and long-term variable rates

- Income multiples: How much they're willing to lend based on your salary

- Flexibility: How they view bonuses and career progression

- Additional fees: Arrangement fees, valuation costs, and early repayment charges

Remember, the mortgage market changes rapidly. It's crucial to get up-to-date information through a specialist mortgage broker experienced in professional mortgages for healthcare professionals.

Application Process for Mortgages

- Gather Documentation: Prepare your GOC registration, proof of income, and professional indemnity insurance.

- Consult a Broker: A mortgage broker experienced in healthcare professional mortgages can guide you through the process.

- Get a Mortgage in Principle: This gives you a clear idea of your borrowing capacity before property hunting.

- Full Application: Once you've found a property, submit your full mortgage application.

- Property Valuation and Offers: The lender will assess the property and, if satisfied, make a formal mortgage offer.

Market Trends & Alternative Financing Options

While interest rates have been historically low, the Bank of England has indicated potential increases to curb inflation. This could affect mortgage affordability and borrowing costs for optometrists looking to purchase property or invest in their practices.

Additionally, property prices, particularly in urban centers like London, Manchester, and Birmingham, continue to rise. It's advisable to monitor regional market trends to identify potential investment opportunities or challenges.

Alternative Financing Options

- Help to Buy Scheme: This government-backed initiative provides an equity loan for new-build homes. Eligible buyers can borrow up to 20% (40% in London) of the purchase price, interest-free for the first five years. This can be particularly beneficial for optometrists looking to buy their first home.

- Shared Ownership: Optometrists can purchase a share (between 25% and 75%) of a property and pay rent on the remaining share. This option is suitable for those who cannot afford a full mortgage but want to start building equity in a property.

- Professional and Career Development Loans: While primarily for education and training, these loans can support optometrists in furthering their qualifications, which may indirectly enhance their earning potential and mortgage options.

- Green Mortgages: Some lenders offer green mortgages with favourable terms for properties that meet certain energy efficiency standards. Optometrists interested in sustainable living or practice premises might benefit from these options.

- Joint Borrower, Sole Proprietor Mortgages: This option allows family members to assist with mortgage affordability without being co-owners of the property. It can be a useful strategy for optometrists starting their careers who may need additional financial support.

Tax Considerations

Changes in stamp duty thresholds can significantly impact the cost of purchasing property. Optometrists should be aware of any temporary reliefs or permanent changes to these thresholds, especially if buying high-value properties or additional homes.

Capital Gains Tax

If an optometrist sells a property that is not their main residence, they may be liable for capital gains tax on any profit made. Understanding the current rates and available allowances is essential for effective financial planning.

Ready to Explore Your Mortgage Options?

Ready to explore your mortgage options as an optometrist? Don't navigate this complex landscape alone. Contact Clifton Private Finance today for expert advice - we specialise in professional mortgages for healthcare professionals, including optometrists. Our experienced brokers can help you unlock the best rates and terms tailored to your unique situation.

Call us on 0203 900 4322 or book a consultation on our website to start your journey towards property ownership or practice investment.

FAQs

How does being an optometrist affect my mortgage application?

Lenders often view optometrists favourably due to their stable career path and earning potential. This can result in higher borrowing limits and more competitive interest rates.

Can newly qualified optometrists access professional mortgages?

Yes, many lenders offer professional mortgages to newly qualified optometrists. However, you may need to provide evidence of your qualification and registration with the General Optical Council.

How much can I borrow as an optometrist?

While it varies by lender, many offer up to 5-6 times your annual income. For instance, an optometrist earning £55,000 might borrow up to £330,000.

Are there special mortgages for buying an optometry practice?

Yes, commercial mortgages and practice loans are available specifically for purchasing or investing in optometry practices. These often have different terms than residential mortgages.

How does locum work impact my mortgage application?

While some lenders prefer steady employment, many recognise the nature of locum work in optometry. They may evaluate your day rate and contract history instead of requiring a long-term permanent position.

Can I get a mortgage if I'm buying into a partnership?

Yes, many lenders offer mortgages for optometrists buying into partnerships. You'll need to provide details of the partnership agreement and your projected income.

How often should I review my mortgage as an optometrist?

Given the potential for significant salary increases in optometry careers, it's advisable to review your mortgage every 2-3 years to ensure you're benefiting from the best available rates and terms.