Categories

Structured Finance | How it Works

At Clifton Private Finance we work with companies at all stages of development, from startups through to multinational corporations.

At the top end of the funding scale lies structured finance.

But what is structured finance, and can it help your company leverage assets to generate substantial and meaningful investment capital to fund your next major project? Read on to understand the power of structured finance as we unravel some of its complexities.

To discuss your finance requirements with our team, please book a consultation below:

What is Structured Finance?

Structured finance is a sophisticated approach to financial management that enables companies and institutions to generate large-scale capital funding while managing a range of complex financial risks.

With structured finance, relevant assets are separated from the main bulk of the company, placed into a dedicated business entity, and then offered for investment in layers. This provides opportunities for different levels of investors; those who prefer a stable, cautious approach can utilise a low-risk, low-reward strategy; while speculative investors looking to make the most of their capital can opt for a high-risk layer with the potential for extremely high rewards.

It is this flexibility that is at the core of structured finance.

Able to generate large sums of investment capital for businesses with substantial assets, structured finance funds massive projects, from large property developments to infrastructure regeneration to corporate acquisitions.

How Structured Finance Works - 6 Steps

1. Understanding Securitisation

The core method that enables structured finance is a process known as securitisation, which creates tradeable securities. This involves the creation of a separate entity, or Special Purpose Vehicle (SPV), essentially an independent company that manages the asset pool.

The SPV takes ownership of the assets, effectively purchasing them from the originator through capital provided by the investors. It is this process that gives the originating company the funds it was seeking, that it now has available to use for its project.

Obtaining the funds, however, is only the first stage of structured finance and securitisation. While the originating company is now free to undertake its aims, the SPV must take over managing the assets and providing the investors with a return on their investment.

2. Defining the Assets

The underlying assets in the SPV's pool are typically lending portfolios and receivables owned by the originator, such as mortgages, asset finance agreements, credit card debt, and secured loans.

In bulk, these financial assets can be leveraged to entice significant investment.

There are a wide range of securities that can be used for structured finance, including:

- Mortgage-Backed Securities (MBS) - Backed by residential or commercial mortgages.

- Collateralized Debt Obligations (CDO) - Backed by a mix of loans, bonds, or other assets.

- Asset-Backed Securities (ABS) - Backed by consumer assets like car finance, credit cards, or leases.

- Collateralized Bond Obligations (CBO) - A type of CDO backed specifically by bonds.

By utilising these asset pool structures, structured finance allows organisations across different industries to access large-scale funding.

3. Funding the SPV

For the SPV to have the capital required to fund the originator and purchase the assets, it needs to sell securities to investors. These securities represent claims on the cash flows generated by the underlying financial assets, such as loan repayments and interest.

Once all its securities are sold, the SPV provides the capital to the originator and focuses on managing the assets and cash flow.

4. Tranches and Subordination

A key feature of structured finance, at the core of its ability to entice a wide range of investors, is the concept of tranches. These create multiple layers of risk and return, each designed to appeal to a different type of investor.

There are three tranches in structured finance:

Senior Tranche - The safest layer, the senior tranche offers minimal risk and a lower reward. Senior investors are paid first at all times, even in the event of losses occurring. The senior tranche appeals to those investors who are risk-averse, such as pension funds.

Mezzanine Tranche - The middle layer balances risk and reward. Mezzanine investors are more willing to take on risk than senior investors, in exchange for a comparably higher reward. Mezzanine investors may include private equity firms or insurance companies.

Equity Tranche - A high-risk, high-reward tranche, the equity tranche is the ‘first-loss position’ that will be paid last, meaning that losses have an immediate and often costly effect on equity tranche investors. With the potential return as significant as the risk, the equity tranche appeals to hedge funds and other investors willing to gamble.

Subordination is the process by which payments are separated and made according to the tranche, with any losses absorbed from the bottom up.

To illustrate, consider an SPV holding a £250 million asset portfolio of mortgages:

- The senior tranche represents £180 million of investment, at a 3% annual return. A pension fund invests £5 million in the senior tranche.

- The mezzanine tranche represents £50 million of further investment, at a 6% return. A private equity firm invests £5 million in the mezzanine tranche. The equity tranche represents £20 million, with potential returns exceeding 10% per year. A hedge fund invests £5 million in the equity tranche.

- At the end of a year, if defaults on the loans are low and the assets remain strong:

- The pension fund (senior tranche) receives £150,000 in interest payments.

- The private equity firm (mezzanine tranche) receives £300,000 in interest payments.

- The hedge fund (equity tranche) receives £500,000 or more in interest payments.

However, if in the second year defaults are high, the equity tranche investors could lose much of their investment. If defaults reach 4% of the asset pool (£10 million), the tranches absorb the losses in reverse order of priority. The equity tranche (valued at £20 million) would absorb the entire £10 million in losses, leaving only half of its principal intact.

This would result in the following payments at the end of the second year:

- The pension fund (senior tranche) still receives £150,000 in interest payments, fully shielded from the losses.

- The private equity firm (mezzanine tranche) again receives £300,000 in interest payments, also protected by the equity tranche.

- The hedge fund (equity tranche) receives £0 in interest payments and loses 50% of its investment, retaining only £2.5 million of value.

5. Overcollateralisation and Reserve Accounts

In addition to the tranche subordination, there are two other main principles that are used in structural finance to protect the investors, these are overcollateralisation and reserve accounts.

Overcollateralisation

Overcollateralisation is when the assets provided to the SPV by the originator are greater than the sum of investment funding.

This can be seen in a similar way to a loan-to-value (LTV) calculation in traditional asset-based loan structures. By providing more assets than are needed to secure funding, overcollateralisation acts as a buffer that helps protect all tranches of investment, though equity investors may still experience reduced returns.

Consider the existing example. If £280 million of assets were in the pool, with only £250 million leveraged, then the SPV has £30 million in assets that can be lost before the equity tranche needs to absorb financial losses.

Reserve Accounts

A reserve account is similar to overcollateralisation but consists of a dedicated pool of capital, rather than additional assets, set aside to absorb losses. A reserve account holds a fixed sum - for example £10 million - that can absorb losses before the equity tranche takes the hit.

Replenishing Overcollateralised Assets and Reserve Accounts

If the cash flow exceeds needs, then reserve accounts are replenished. In some SPV structures, additional assets can also be acquired to replenish overcollateralisation, though this is rarer.

6. Closing the SPV

Over time, the asset pool for the SPV naturally shrinks as the loans and receivables which it holds are paid off and the cash flow channelled to the investors. Eventually, the terms of all its assets come to an end and the SPV’s purpose is complete - remaining investors will have received their principal and profit.

At that point, the SPV is closed and any remaining funds held (including unused funds in the reserve accounts, or additional capital from overcollateralised assets) are returned to the originator.

Who Is Structured Finance For?

While structured finance is regularly used by banks and investors, it is a financial tool that is available to many companies across a range of industries. The following are all examples where structured finance is used:

- Mergers and acquisitions

- Large expansion projects for multinational corporations

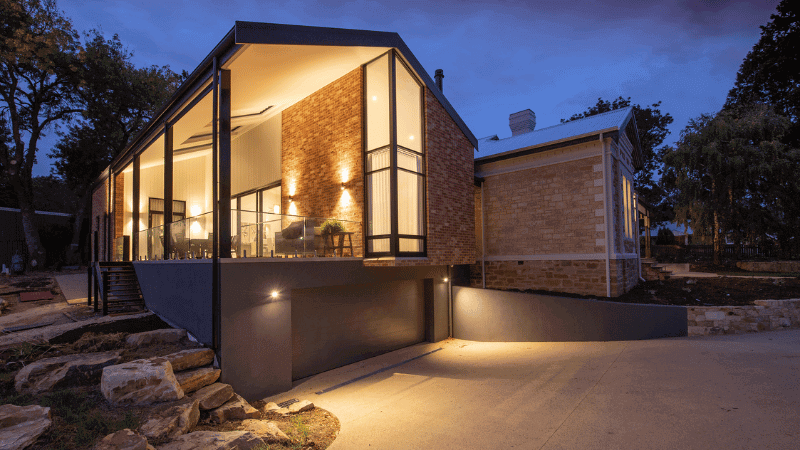

- Housing developments

- Urban regeneration projects

- National infrastructure development

- Renewable energy facilities

- Scientific and medical research

For companies with unconventional financial needs, structured finance provides unparalleled flexibility that traditional lending models cannot match.

Structured Finance Risks

Structured finance is extremely powerful, but it can come with multiple risks:

- Market Instability - Debt-based assets are tied to wider market conditions. Economic downturns can significantly affect the performance of the asset pool.

- Counterparty Risk - The reliance placed on the SPV’s partners, such as the originator, service providers, or ultimately the borrowers themselves, increases risk in long-term investment strategies such as structured finance.

- Overall Complexity - Expertise is needed to understand the details of tranches, subordination, and securitisation.

Working with a trusted specialist finance partner such as Clifton Private Finance helps mitigate these risks.

We work with trusted lenders, provide transparent strategies and advice, and work with you to structure deals that balance ambition with an experienced degree of caution.

How Clifton Private Finance Helps

With proper understanding and expert management, structured finance provides the large-scale funding to see ambitious projects to fruition.

Clifton Private Finance is a trusted partner for businesses and developers looking to use the power of structured finance. We offer:

- Expert Guidance - Our corporate finance team help clients navigate the complexities of SPVs, tranches, and securitisation.

- Tailored Solutions - By working together to understand your unique needs, we develop structured finance deals that deliver optimal results.

- Trusted Network - With established relationships with a wide range of reputable lenders and investors, partnering with Clifton Private Finance ensures you gain access to the very best funding options available.

If your company is looking into structured finance, Clifton Private Finance have the expertise, relationships, and understanding needed to succeed. Contact us today to discover how structured finance can propel your company forward.