Categories

NEWS: Average Mortgage Repayments Up 60% Since 2021

The average buyer's annual mortgage repayments in 2024 have reached £11,400, and getting a good deal is more important than ever.

According to new data from Zoopla, the average homeowner in the UK faces annual mortgage repayments of £11,400 in 2024. This is up 60% since 2021, when repayments averaged £7,000 per year. This rise in mortgage costs places financial pressure on homeowners as many anticipate a drop in mortgage rates.

The increased financial burden is primarily driven by rising interest rates and inflation, and many individuals are taking the hit and sticking with a variable-rate mortgage while they wait for mortgage rates to drop.

The average household is contending with an additional £4,320 in annual mortgage payments, but the impact is more severe in London and Southern England, where property is more expensive.

In London, homeowners are grappling with an average of £23,000 in annual mortgage payments, up by £7,500 since 2021.

The South East and South West are similarly affected, with annual repayments rising by £6,000 and £5,300, respectively.

In contrast, homeowners in other parts of the country are experiencing less severe increases. In the Midlands, annual mortgage payments have risen by £3,900, while in the North East, the increase is only £2,350.

Read blog: Are Mortgage Rates Going Down?

The Impact of Rising Mortgage Repayments

Mortgage rates have spiked twice since 2022—the first was after the Autumn mini-budget and after the bank rate was increased to 5.25% in August 2023.

These hikes have diminished buyers' purchasing power, reduced homeowners' disposable income, and significantly affected the housing market. Sales dropped 23% over 2023, and house prices declined modestly.

In January, rates were seen below 4% for the first time since 2022, reflecting significant optimism surrounding the base rate and inflation. But rates have returned to approximately 5% again amid shifting expectations for interest rate cuts later this year.

The low rates we saw in 2021 are increasingly a thing of the past as more households' fixed-rate deals come to an end. Similarly, many homeowners are downsizing, releasing equity, or relocating to help make ends meet.

However, inflation is on track to drop below 2% in the coming months, and many experts are confident a base rate reduction is on its way. Once the base rate is reduced, mortgage interest rates will follow suit, bringing some relief for households currently under financial pressure.

Related: Can I Get a Mortgage for 5 or 6 Times My Salary?

What Do the Experts Say?

George Abouzolof

Senior Finance Broker CeMAP

The immediate impact of a 0.25% reduction will be a drop in mortgage payments for those on base rate trackers. Paying 0.25% less on a £1m interest-only mortgage equates to £2,500 less per year. So, the savings across the mortgage industry could be huge.

Fixed rates are unlikely to follow suit unless government bond yields relax - which they have done month-on-month. Most borrowers are opting for two-year fixes in the hope that rates will continue to drop in the future.

Relations with the US could pose a threat to the economy’s recovery. Trump is highly US-focused, and is prioritising American brands, as well as removing incentives for sustainable tech. This could make trade with US more difficult.

There are signs that US administration could go on a spending spree, which could also have a knock-on effect on us.

However, the overall sentiment has been much more neutral than we might have expected. While some landlords have been put off, for many, it’s business as usual. Investors are looking where they can to make a profit and overcome the current climate.

We’re still seeing a steady influx of first-time buyers and buy-to-lets, which could be a sign of the anticipated rush to purchase ahead of the upcoming stamp duty changes.

Furthermore, we haven’t seen a decrease in foreign investment so far, despite claims that the Autumn Budget would impact this.

Alex Chambers

Senior Private Client Adviser

With inflation forecast to continue falling, financial markets expect the Bank of England to cut rates to 4.75% by December 2024.

The economy is on the mend. It grew more than expected, by 0.6% in the first quarter of the year, meaning that we are no longer in a recession. According to Halifax, UK house prices also rose by 0.1% in April.”

What the public thinks...

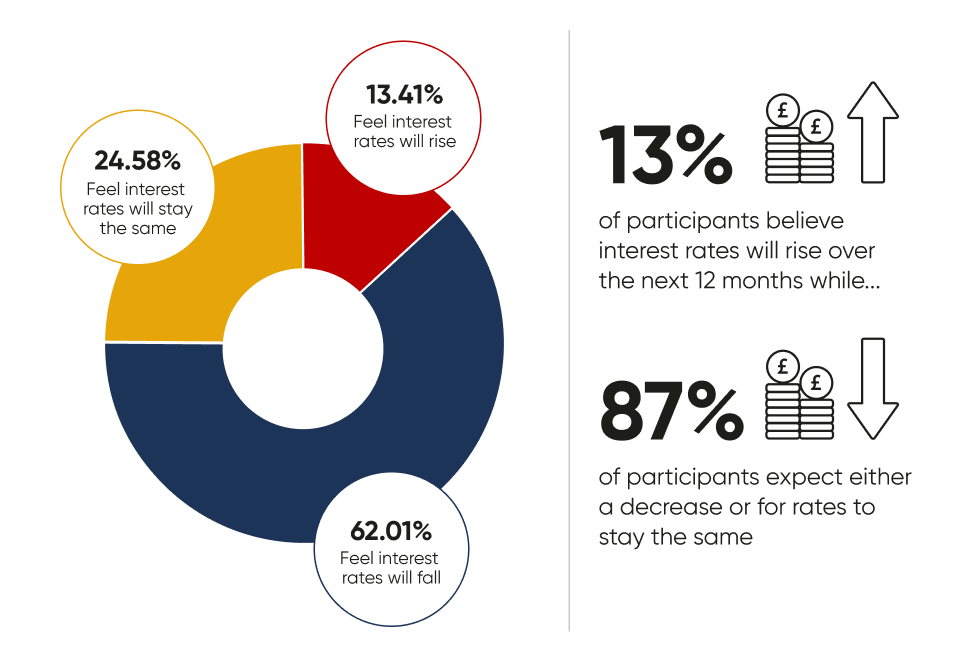

Just 13% of participants believe interest rates will rise over the next 12 months, while 87% expect either a decrease or for rates to stay the same.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the coming months.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

Read our full survey results »

See similar: How Much Will My Mortgage Go Up in 2024? & How Will the Election Affect the Property Market?

What Next?

Amid an elevated cost of living, access to the best rates is more important than ever. Working with an independent, whole-of-market mortgage broker allows you access to the best rates on the market. A good broker can connect you with a suitable lender and offer expert guidance along the way, ensuring the process is as smooth as possible.

Whether you’re remortgaging, releasing equity or purchasing a new property, at Clifton Private Finance, we can accommodate your needs and make sure you get the best deal for your unique circumstances.

To see what we can do for you, call us at 0203 900 4322 or book a free consultation below.