Categories

NEWS: First Time Buyers Dominating London Market

London is seeing an increase in purchasing activity from first-time buyers despite high cost-of-living and homebuying costs. Here's how you can navigate the evolving London market.

Written by Luka Ball

According to new data, in 2023, London saw 181,000 first-time buyers purchase homes. This marks a 24% annual increase, the highest it has been in 20 years. This increase occurred despite the average age of a first-time buyer increasing to 35.3 for the 2022/23 period (up from 33.8 years) and interest rates being much higher than they were in 2022.

First Time Buyer? Get a Quote

How Are London Buyers Overcoming the Odds?

Following a decade of elevated housing costs and four years of economic turbulence, first-time buyers rely on support to afford a mortgage.

Nearly two-thirds of buyers are applying for mortgages with partners, siblings, or friends to afford their first homes. This is primarily because elevated living costs have made it challenging to drum up a deposit, and it may also be difficult to tackle affordability in the face of increased interest rates.

House prices may have dropped slightly in London, but property remains significantly more expensive than the average wage. Eight of the ten least affordable local authorities for first-time buyers are in London, and Islington tops this list, with a house price-to-earnings ratio of 10.6.

First-time buyers benefit from a drop in asking prices due to the UK’s ongoing housing slump. This has brought the average price of a property in London down to £492,200, but the average deposit is still a whopping £108,850. While buyers may be experiencing a slight year-on-year reprieve in housing prices, the average deposit is still 85% higher than in 2013.

See similar: How Will the Election Affect the Property Market?

Changes to Buyers’ Appetites in the Capital

In the face of affordability challenges, flats have become the predominant choice among first-time buyers in London. They comprised 73% of homes sold in 2023, up from 59% in 2013. This is largely due to an oversupply of studios and one-bedroom flats, which are generally more affordable.

The shift towards remote work has influenced this. Over 40% of London workers now work either hybrid or completely remote, with 80% of those earning over £50,000 working from home at least part-time. This trend has impacted the types of properties first-time buyers seek, with many opting for larger homes that can accommodate home offices.

Despite predictions of a 2% average decrease in house prices since 2023, a report by Rightmove shows that costs are beginning to pick up again in response to the increasing buying activity.

Here's the average asking price for a first time buyer in 2024, according to Rightmove, and the percentage increase compared with 2019.

Photo: The Standard

High costs on larger properties are prompting first-time buyers to plan for fewer upsizes, starting with small family homes rather than studio flats. Over half of these buyers now purchase two-bedroom homes, and 40% opt for three-bedroom or larger properties.

New buyers entering the property market will need to be prepared for higher mortgage payments, with estimates suggesting an increase of around £400 per month compared to five years ago. The current average first-time buyer mortgage continues to reflect the significant financial commitment required to step onto London’s property ladder.

While the challenges of buying a first home in the Capital remain a barrier for many entering the market, evidence shows that it is still doable.

Related: Guide to Bank Statements When Applying for a Mortgage

See the latest market news below.

Where Are the Most Affordable Places in the UK to Buy a Home?

House prices are rising, but not as rapidly as they were before 2022.

In 2024, we did see a modest rise in house prices, but since the budget, this has come down slightly. The Bank of England base rate has dropped, but mortgage deals don’t seem to be moving in response to the Autumn Budget, which has since been widely considered inflationary.

As the housing market begins to recover from the past four years of economic turbulence, there seems to be a case of push and pull between house prices and interest rates restricting affordability.

Limited affordability has caused a visible divide between the UK’s most and least affordable housing. And unfortunately, in more expensive areas, first time buyers aren’t getting to enjoy much of a drop in house prices because the difference is made up by high interest rates and less favourable mortgage deals.

Mortgage rates have come down slightly from their 15-year high, and while the housing market does seem to be on the mend, it’s still not the easiest time to buy property for first-time buyers and investors alike.

For buy to let investors, regulations have gotten stricter since 2022, and high mortgage rates have thinned profit margins, making owning a standard buy to let a trickier affair than a decade ago.

While house prices have dropped slightly due to lack of affordability across London and the rest of the South, this isn't the case in other regions.

But this isn't the case everywhere in the UK. The North of England has seen entirely different purchasing behaviour to the South since the early 2000s. In select areas, particularly Yorkshire, North Lincolnshire and Durham, you can still easily buy a property for under £100,000.

Due to affordable housing and cheaper living costs in these areas, most of Northern England and Scotland have been resistant to the housing slump that the rest of the UK has experienced in response to high mortgage rates. The property market in these regions has remained robust and has seen growth throughout 2024.

There's certainly hope, both for property investors and those looking to get on the housing ladder. If you're looking to invest in a buy to let in 2024, it may be worth looking in affordable areas with a consistent rental demand, such as university towns or areas close to large employers. Property hotspots like these are still reaping generous rental yields while the rest of the country is seeing slow growth.

For first-time buyers, house prices coming down significantly could make it much easier for them to get on the housing ladder, but in many cases, house prices going up is beneficial for those using equity in their homes to make another purchase.

What Are The Current Mortgage Rates?

Here's a table of current mortgage rates that we've recently secured for clients:

2 Year Fixed

Up To £1m

3.55% APR

2 Year Fixed

Subsequent rate 7%

LTV - 60%

APRC 6.1%*

Product Fee £999

Early redemption charges

As of 29th December 2025

5 Year Fixed

Up To £10m

3.75% APR

5 Year Fixed (Purchase)

Subsequent rate 7.24%

LTV - 60%

APRC 5.6%*

Product Fee £995

Green product

Early redemption charges

As of 29th December 2025

2 Year Tracker

Up To £2m

3.94% APR

2 Year Tracker (Purchase)

Subsequent rate 7.24%

LTV - 60%

APRC 6.4%*

Product Fee £995

Early redemption charges

As of 29th December 2025

Contact Us

Thank You for your interest - please complete the form below and a member of our team will be in contact.

What Do Our Readers Think?

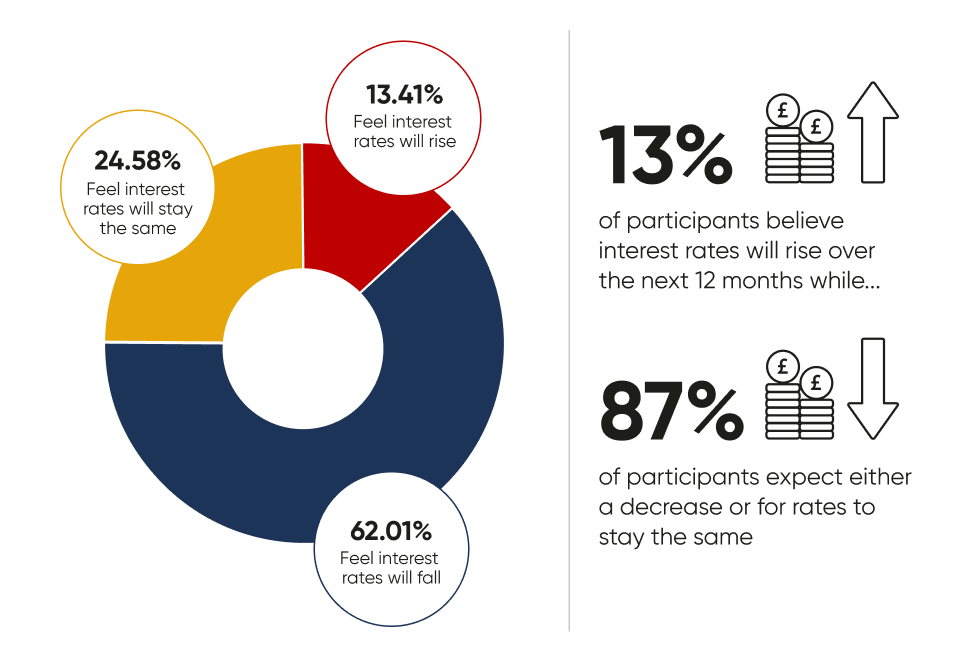

Just 13% of participants believe interest rates will rise over the next 12 months, while 87% expect either a decrease or for rates to stay the same.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the next coming months.

This sheds some light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the coming months.

Read our full survey results »

Read blog: How to Get a Professional Mortgage

What Next?

Amid an elevated cost of living, access to the best rates is more important than ever. Working with an independent, whole-of-market mortgage broker allows you access to the best rates on the market. A good broker can connect you with a suitable lender and offer expert guidance, ensuring the process is as smooth as possible.

Whether you’re remortgaging, releasing equity or purchasing a new property, at Clifton Private Finance, we can accommodate your needs and make sure you get the best deal for your unique circumstances.

With a local office based in Marylebone, Clifton Private Finance has specialist bridging loan brokers who are able to assist with alternative finance options to standard mortgage products. For those looking to move quickly in the market, buy property at auction, or renovate an uninhabitable property, a bridging loan is a powerful short-term lever that allows you to act as a cash buyer.

To see what we can do for you, call us at 0203 900 4322 or book a free consultation below.