Categories

2024 Property Market Review: What Happened & What’s Next?

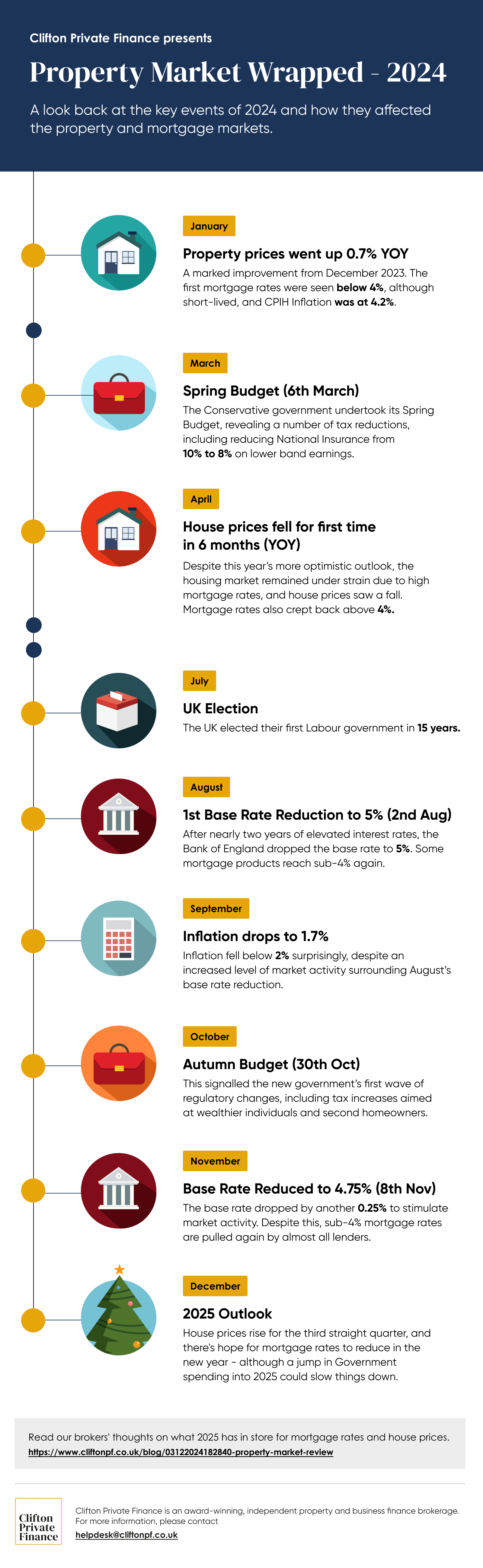

As the year comes to a close, we reflect on the numerous factors that have shaped the market this year and what we can expect in 2025.

The General Election and subsequent new government resulted in a controversial Autumn Budget, announcing the first of many budgetary U-turns. As well as the much-anticipated Bank of England base rate reduction, fluctuating inflation, and political uncertainty and an election for our US neighbours have all contributed to where the market now stands.

High mortgage rates and affordability have overshadowed large improvements in the housing market, but it’s still important to acknowledge how the landscape has changed over the past 12 months.

Compare rates and get an instant quote using our online mortgage calculator

The Election & The Budget

The political landscape also saw a dramatic change with the election of the first Labour government in 15 years. The new administration wasted little time signalling its priorities, introducing tax reforms and changes to the fiscal policy in the Autumn Budget.

These changes sparked debate, posing challenges for property investors and landlords. The Renters’ Reform Bill alongside increases to Stamp Duty and Capital Gains Tax has discouraged from buying, but it’s likely that if mortgage rates drop significantly in the future that a number could return to the market. Until then, it’s possible that these changes could make the housing more accessible for first time buyers or buyers looking to upsize.

The Base Rate

After nearly two years of elevated levels, the Bank of England implemented its first base rate cuts since the tightening cycle began in 2021.

These reductions are a result of the Bank of England’s efforts to curb inflation, which rose to over 11% in 2022. Slowing inflation and a drop in borrowing costs has eased some of the financial pressure we’ve been experiencing since the beginning of the cost-of-living crisis. Which has revived some confidence in the housing market.

The Property Market

Affordability has remained a central concern for the property market. This is primarily because house prices are climbing again in response to renewed purchasing activity, combined with the fact that mortgage rates haven’t come down as significantly as was expected after the base rate was reduced.

Even as inflation fell and borrowing conditions improved, the effects of prolonged economic strain were still evident in subdued price growth and regional variations in market performance.

But both buyers and sellers adapted to the changing environment, finding opportunities in areas of the market that showed signs of recovery. Cities like Manchester, Leeds, Edinburgh and Belfast have seen continued growth.

As we close out 2024, the property market stands at a crossroads. With the groundwork laid this year—through fiscal and administration changes, and economic stabilisation— it’s possible we could see a gradual stabilisation in 2025.

Uncertainties do remain, but the progress we’ve seen this year offers a renewed sense of possibility and optimism.

Looking to 2025: Our Experts Weigh in

George Abouzolof

Senior Finance Broker CeMAP

It’s possible that product rates will remain static during the New Year, but with the usual Christmas purchasing trends, it’s likely that inflation will climb higher.

The Autumn Budget announced a rollout of new government spending, which tends to drive up inflation and impacts mortgage rates.

It’s possible that the Bank of England base rate will be held after the next inflation announcement, and it’s unlikely it’ll be reduced further unless something in the market changes significantly.

I’m seeing less buy to let purchases since the Budget, which likely has a correlation with the new property tax hikes. Some landlords are leaving the market due to increased costs eating away at rental yields, but this could free up more housing stock for residential buyers.

Darcie Mackenzie

Finance Broker CeMAP

We’re all hoping that mortgage rates will come down steadily in the New Year, but there’s been a jump in government spending following the Budget which could pose an obstacle and slow the rate at which we see reductions.

However, it would be great to see rates drop to 4% in 2025 and perhaps this may mean lower loan-to-value clients can access rates within the mid-3s and even lower.

There are a few factors at play that could cause interest rates to rise or fall, and whichever has the most leverage will tip the scale. With this uncertainty in mind, it’s important to be savvy when selecting products.

For a number of clients in the current buy-to-let market, choosing a lower interest rate product with higher application fees may be the only way an investment purchase or refinance is possible, due to the amount of room required between the monthly payment and the rent received.

Landlords are being tied into restrictive markets due to a lack of two-year fixes as lenders impose tighter affordability rules in this area, but if this causes the market to slow, products could become more competitive.

It is also important to note any trends. Back in 2018/19 when we could source sub 1% rates, a higher rate was charged for longer scheme lengths, which suggested that lenders felt rates could be on the increase over the next 5 years, and they were right. Now, however, the longer schemes carry the lowest rates, which could suggest a flip in their thinking and perhaps they expect significant drops over the next 5 years.

How Can You Find an Affordable Mortgage in 2024?

Despite the optimism about declining mortgage rates, deciding on the best option can still be daunting.

We can help you compare mortgage products and their cost to find the best deal based on your specific situation from a wide range of lenders nationwide.

Related: What is a professional mortgage and can you get one?

Expert mortgage advisors have their finger on the pulse of the latest mortgage market news. Whether you're a first-time buyer or looking to refinance or invest in a BTL, we can help you understand your mortgage options so you feel confident you're making the right choice.

To see what we can do for you, give us a call at 0203 900 4322 or book a free consultation below.