Categories

BoE Holds Base Rate at 3.75% | What it Means for Your Mortgage [February 2026]

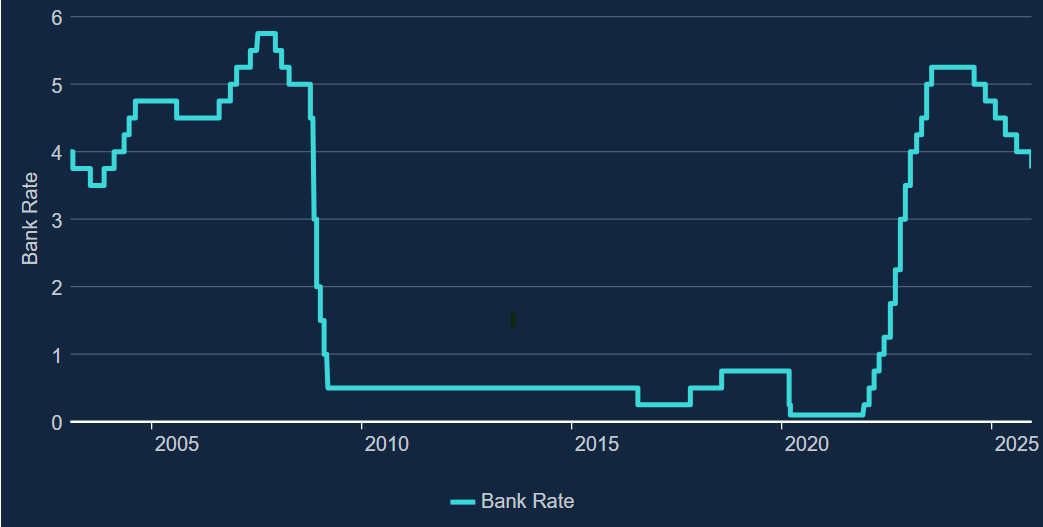

The Bank of England has voted to hold the base rate at 3.75% in February 2026, which keeps the rate at the lowest level it has been for 3 years. What does this mean your mortgage?

During 2025, the Bank of England began easing monetary policy. In February last year, the base rate was reduced to 4.5%, followed by a further cut to 4.25% in May. After August’s reduction to 4.0%, the rate was held steady; reinforcing expectations that the next move could be another gradual cut. This came in December with the drop to 3.75%.

Mortgage borrowers on new fixed-rate deals have already seen gradual rate reductions since the start of the year, with sub-4% rates being offered by many of the major lenders in the early months of 2026.

For those looking to remortgage in 2026, you may not see the low rate levels that were available in 2021-2022, but the market has more favourable options now than it did 12 months ago.

At Clifton Private Finance, we’ve already seen multiple lenders with competitive options now priced below 4%.

Here's a current snapshot (updated live):

Get a Free Quote Today

Key Takeaways

- The Bank of England has held the base rate at 3.75%, as part of its strategy to gradually ease borrowing costs.

- Homeowners on tracker mortgages will see their monthly payments reduce, while fixed-rate borrowers are likely to benefit as lenders are offering competitive sub-4% mortgage rates.

- Falling mortgage rates could improve affordability, helping first-time buyers and home movers enter the market with greater confidence.

- With over 1 million fixed-rate deals ending in 2026, the competitive mortgage market offers some relief at a crucial time for homeowners considering a remortgage.

Why Was the Rate Held?

Over the past few years, the Bank of England has taken a hawkish stance towards the base rate. But with inflation running higher than the 2% target and a need to stimulate more economic growth, industry experts widely expect the strategy of gradual easing to continue.

The decision to hold the rate at 3.75% comes as no surprise, as consecutive rate drops are very rare.

The base rate is the main way that the Bank of England controls inflation, so if inflation rises significantly, it's likely the bank rate would be increased again. Keep an eye on inflation figures if you want a better idea of where rates may be heading next.

It’s unlikely that interest rates will return to the super-low levels we saw before 2022, but 5-year fixes dropping consistently across the board is certainly a sign that there are more reductions to come.

In this article, our mortgage brokers weigh in on the discussion, and we analyse the bigger picture of the UK economy, inflation, and the mortgage market in this article.

See similar: Are Mortgage Rates Going Down?

What Do Our Experts Say?

George Abouzolof

Senior Finance Broker CeMAP

In February 2026, the Bank of England has decided to hold the base rate at 3.75%, following a drop from 4.00% in late 2025. Consecutive drops are very rare, so this comes as no surprise.

Measures announced in the Budget are expected to place some pressure on household spending, which can help ease inflation over time.

Mortgage borrowers may see some lenders increase rates very slightly in the short term, but the Bank of England's stance is to continue cutting the Base Rate through 2026, which will likely ease borrowing rates in the longer term.

Read blogs: Should You Get a Tracker or Fixed Rate Mortgage in 2024?

The graph below shows how the bank rate has increased since mid-2021 and is now dropping back down.

(Credit: Bank of England)

How Does Inflation Influence the Bank Rate?

The country is still recovering from high inflation rates that led to an elevated cost of living in 2022. The Bank of England controls inflation primarily by adjusting the bank rate, which determines the cost of borrowing across the nation. Higher interest rates mean that borrowing is more expensive, which limits economic activity.

Reduced economic activity will typically cause inflation to fall. However, it's also important that inflation doesn't fall too low. If this does happen, people may put off spending en masse in hopes that prices will drop. When spending stops completely, whole systems and companies can come to a grinding halt.

The aim is to keep inflation low and stable.

How Did Inflation Get So High?

COVID-19 caused a shortage in products and services in 2020, and this demand led to increased prices. Then, Russia’s invasion of Ukraine impacted energy and food prices. Finally, it became evident in 2022 that thousands of people had left the workforce following the pandemic. This pushed up hiring costs, and many businesses subsequently raised their prices.

These three major hits to the economy contributed to the current cost-of-living crisis. Because major events have a relationship with inflation, the long-term view on inflation is never set in stone, but experts can make an educated guess with the data they do have.

Inflation is now close to the BoE's target of 2%, which many feel is the primary reason the bank has lowered interest rates.

Now that the base rate has been dropped again, many experts are confident that we'll see a slight uptick in inflation, but there may well be room for further base rate reductions in the future.

How to Find an Affordable Mortgage in 2026

Despite the optimism about declining mortgage rates, deciding on the best option can be daunting and confusing.

We can help you compare mortgage products and their costs to find the best deal for your specific situation from a wide range of lenders nationwide.

Expert mortgage advisors have a finger on the pulse of the latest mortgage market news. Whether you're a first-time buyer, looking to refinance, or investing in a buy-to-let, we can help you understand your mortgage options so you feel confident you're making the right choice.

To see what we can do for you, call us at 0203 900 4322 or book an appointment below.