Categories

The Ultimate Guide to Buying Property in Regent's Park

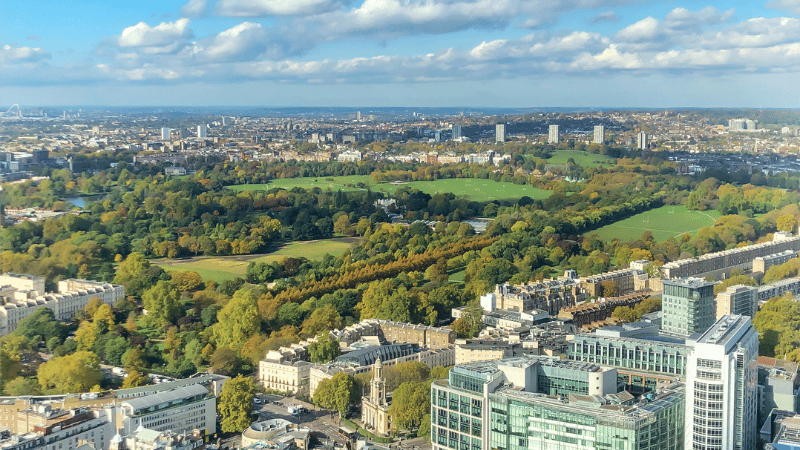

Regent's Park, a crown jewel in London's property landscape, offers an unparalleled blend of regal history, verdant open spaces, and prestigious residences. This iconic area, home to the eponymous Royal Park, London Zoo, and world-class cultural institutions, has long been a magnet for discerning buyers seeking the pinnacle of urban living in the heart of the capital.

This comprehensive guide will walk you through everything you need to know about purchasing property in this esteemed Prime Central London (PCL) location. We'll explore recent price trends, investment yields, and the world-class amenities that make Regent's Park one of London's most coveted residential areas.

Table of Contents

Regent's Park's Property Landscape

Regent's Park's Quarterly Market Activity

Types of Properties Available in Regent's Park

Prime Regent's Park Property Market Forecast

Comparing Regent's Park to Other PCL Areas

How to Finance Your Regent's Park Property

Regent's Park's Property Landscape

Regent's Park offers a prestigious property market, with various options for those seeking a prime London address.

Recent market trends and overall data sourced from Coutts’s London Prime Property Index Q4 2023 – it encompass data for St John’s Wood, Regent’s Park & Primrose Hill.

Let's examine the data:

Recent Market Trends

- Average Price: As of Q4 2023, the overall average sold price for properties in Regent's Park was £1,938,629.

Property Types

There's a significant price difference between property types:

- Flats: Average price of £1,205,839

- Houses: Average price of £5,096,458

Price Growth

Overall sold prices were down 2.9% compared to the previous year, reflecting broader market trends in Prime Central London.

Rental Yields

Properties in the area yielded an average of 4.72% in rental income, making it an attractive option for investors.

Breaking down the house prices further:

- Terraced properties: £4,728,333

- Semi-detached properties: £2,900,000

- Detached properties: £7,250,000

Market Segments and Pricing

Properties Under £1M

- Average Sales Price per Square Foot: £972

- Time on Market: 178 days (average across all price bands)

£1M to £10M Properties

- Average Sales Price per Square Foot: £1,446

- Time on Market: 178 days

- Percentage Sold at a Discount: 81.0%

- Average Discount: 10.0%

Ultra-Luxury Properties (£10M+)

- Average Sales Price per Square Foot: £2,536

- Limited transactions, reflecting the exclusivity of this segment

See the latest market news below.

2025 Prime Central London Market Update

The Prime Central London market has seen some changes over the past few years, with prices impacted by a slump that has taken over the UK housing market. But according to recent research, the tides could be about to turn.

There have been fears that the recent dissolution of the Non-Dom tax status would dampen interest from overseas investors, in favour of more appealing tax-friendly destinations Dubai, Switzerland, and Monaco.

But it seems London remains a compelling investment spot - namely due to its reputation as a major financial hub, its history and architecture, convenient timezone for corporate travel and access to world-class education.

Furthermore, while the non-domicile status is being abolished, it’s being replaced with a new scheme aimed at temporary UK residents, with ‘internationally competitive arrangements’.

The UK’s prime property market has also become heavily influenced by Donald Trump’s return to the White House. The strengthening US dollar has increased the appeal of high-end UK real estate for American buyers and those from dollar-linked economies, including parts of the Middle East.

According to data from Knight Frank, US buyers accounted for 6.1% of London property purchases in the first half of 2024, up from 3.3% in late 2023. Beauchamps also reported a 25% rise in enquiries from US buyers since November.

This, alongside with 600 more skyscrapers being developed in the city centre, London has been dubbed a ‘Manhattan-on-Thames’.

So, it’s not bad news for the Prime Central London markets. Stable inflation, another base rate reduction, and increased levels of activity from both British and international buyers indicate that things are on the upturn.

Regent's Park's Quarterly Market Activity (Q4 2023)

The Regent's Park area witnessed some interesting trends:

- 81% of properties in the £1M to £10M range were sold at a discount

- Annual sales volume growth declined by 22.4%

- The average discount on initial asking prices was 10.0%

- Average gross rental yield stood at 4.72%

These figures indicate a market that currently favours buyers, with opportunities for negotiation on asking prices. Regent’s Park remains popular with the super-wealthy, including billionaires who now prefer renting over buying in central London.

Types of Properties Available in Regent's Park

Nash Terraces

Regent's Park is renowned for its stunning Nash Terraces, designed by John Nash in the early 19th century.

- Architectural Splendour: These properties showcase classic Regency features, including stucco facades and elegant proportions.

- Prime Locations: Many are situated on prestigious streets like Cornwall Terrace and Chester Terrace.

- Historical Significance: Owning a Nash property is akin to possessing a piece of London's architectural heritage.

Luxury Apartments in Period Conversions

Many of the grand houses in Regent's Park have been converted into high-end apartments.

- Period Features: These properties often retain original features like high ceilings and ornate fireplaces.

- Modern Amenities: Expect state-of-the-art kitchens and bathrooms blended seamlessly with period charm.

- Prime Locations: Areas like Park Crescent and Marylebone Road offer converted properties with park views.

Contemporary Developments

Recent years have seen the introduction of ultra-modern luxury developments in and around Regent's Park.

- Exclusive Amenities: These often include concierge services, private gyms, and underground parking.

- Cutting-Edge Design: Expect the latest in smart home technology and energy efficiency.

- Prime Locations: New developments near Regent's Park offer a blend of modernity and access to green spaces.

Mansion Blocks

Elegant mansion blocks, typically dating from the late Victorian and Edwardian eras, are another hallmark of Regent's Park property.

- Spacious Interiors: These properties often feature generous room proportions and high ceilings.

- Communal Gardens: Many mansion blocks boast well-maintained communal gardens.

- Prime Locations: Areas like Prince Albert Road and Baker Street offer sought-after mansion block properties.

For more insights into buying property in other PCL areas such as Holland Park, Kensington, or Westminster explore our comprehensive guides at Clifton Private Finance.

Prime Regent's Park Property Market Forecast

Regent's Park's property market, as a cornerstone of Prime Central London (PCL), reflects broader trends across the capital while maintaining its unique appeal.

Here are some key trends to watch:

- Resilient Demand: Despite recent price adjustments, Regent's Park's status as one of London's most prestigious addresses continues to attract high-net-worth buyers and investors.

- Ultra-Prime Rental Surge: The ultra-prime rental market has seen rents surge by 8.8% in 2023, indicating strong demand for luxury rentals in the area.

- Investment in £10M+ Properties: Total spending on properties priced at £10 million or more reached a record high of £439 million in H1 2023, surpassing the previous peak in 2016.

- Price Stabilisation: While prices have declined since their 2014 peak, the limited supply of prime properties in Regent's Park supports long-term price stability.

The current market presents a nuanced picture for buyers and investors in Regent's Park:

- Buyer's Market: With 81% of properties in the £1M to £10M range sold at a discount in Q4 2023, there are opportunities for savvy buyers.

- Strong Rental Potential: Regent's Park's average gross rental yield of 4.72% underscores its potential for buy-to-let investors.

- Diverse Property Types: The mix of period properties, luxury conversions, and modern developments offers varied investment options.

For a comprehensive analysis of the Prime London market, including emerging opportunities and sector-specific trends, we invite you to explore our detailed Prime London Property Market Forecast.

Comparing Regent's Park to Other PCL Areas

Regent's Park offers a unique proposition within the Prime Central London property market. Let's compare it to other PCL areas:

- Maida Vale - Average rental yield: 5.02% (slightly higher than Regent's Park's 4.72%)

- Paddington - Average rental yield: 5.5% (higher than Regent's Park)

- Victoria, Pimlico, and Westminster - Average rental yield: 5.2% (higher than Regent's Park)

- Kensington and Chelsea - Average rental yield: 3.7% (lower than Regent's Park)

- London Overall - Average rental yield: 3.6% as of Q1 2021 (lower than Regent's Park)

While Regent's Park's rental yields are competitive, its true value lies in its prestige, limited supply of properties, and potential for long-term capital appreciation.

How to Finance Your Regent's Park Property

Investing in Regent's Park's property market requires tailored financing solutions. At Clifton Private Finance, we specialise in arranging bespoke mortgage packages for high-value properties in Prime Central London.

Our services include:

- Access to Exclusive Lender Panels: We connect you with private banks and specialist lenders catering to high-net-worth individuals.

- Expertise in Complex Income Structures: Whether you have foreign currency income or diverse assets, our team understands complex income structures and can guide you effectively.

- Tailored Solutions for UK and International Buyers: We customise financing solutions for UK residents, expats, and foreign nationals.

- Guidance on Tax-Efficient Ownership Structures: We provide insights into tax-efficient property ownership, ensuring you make informed decisions.

Our expert brokers at Clifton Private Finance can craft a financing solution aligned with your long-term financial goals and investment strategy.

To explore how we can assist you in unlocking the potential of Regent's Park's prime property market, please call us at 0203 900 4322 or book a consultation with one of our specialist brokers.