Categories

Mortgages for Accountants: How Much Can You Borrow?

As an accountant in the UK, your career offers financial stability and a promising future, making you an attractive candidate for mortgage lenders. Whether you're a trainee, a newly qualified accountant, or a self-employed professional, understanding the mortgage options available to you is crucial for securing the best deal.

In this guide, we'll explore the key aspects of mortgages for accountants, including:

-

Identifying lenders that understand accountants' earnings

-

Proving your income for a mortgage application

-

Leveraging your future earning potential as an accountant

-

Flexible mortgage options tailored to your needs

-

Property investment opportunities for accountants

We'll also discuss how much you can borrow and the impact of student debt on your mortgage application, as well as provide real-world examples to give you a clear picture of your options.

Find the Perfect Mortgage

In this blog:

Key Features of Mortgages for Accountants

Flexibility for Self-Employed Accountants

Mortgage Options for Trainee and Newly Qualified Accountants

Benefits of Mortgages for Accountants

How Much Can Accountants Borrow?

Property Investment Opportunities for Accountants

Detailed Steps for Application

How a Mortgage Broker Can Assist Accountants

Key Features of Mortgages for Accountants

Understanding Accountants' Earnings and Career Trajectories

Accountants are perceived as low-risk borrowers due to their financial expertise and stable career paths. This perception often results in more favourable mortgage terms, such as higher income multiples and competitive interest rates.

In the UK, lenders may offer accountants the ability to borrow up to 5-6 times their annual income, which is higher than the standard 4-4.5 times income available to most professionals.

Flexibility for Self-Employed Accountants

Self-employed accountants often face challenges in proving their income, but certain lenders understand the unique nature of their earnings and are willing to accept alternative documentation. Typically, lenders require two to three years of business accounts to demonstrate consistent income. However, if your most recent year's income is significantly higher, some lenders may base your borrowing potential on this figure alone.

If you're a self-employed accountant with a net income of £60,000 in the most recent tax year, some lenders might use this figure to determine your borrowing capacity, rather than averaging it with previous years' lower earnings. This could allow you to borrow up to £360,000, assuming a 6x income multiple.

Mortgage Options for Trainee and Newly Qualified Accountants

Even at the start of your career, as a trainee or newly qualified accountant, you are likely to be viewed favourably by lenders. This is because of the clear progression path within the profession, where salaries tend to rise significantly over a short period. Lenders may offer you attractive mortgage terms based on your future earning potential rather than just your current income.

A trainee accountant earning £30,000 annually might be eligible to borrow up to £150,000. However, if you’re set to qualify soon with an expected salary increase to £45,000, some lenders might consider this future income when determining your borrowing capacity, potentially increasing it to £225,000.

However, rates can differ slightly depending on where you’re located. As Neil Ormesher, CEO of Accounts and Legal, explains “While it’s true that accountants often receive favourable mortgage terms, variations in local housing markets can impact gains. For example, Manchester accountants may not receive as much of a boost as their London counterparts due to the slightly more competitive market conditions in the South of England”.

Benefits of Mortgages for Accountants

- Preferential Interest Rates - Due to the perceived financial stability of the accounting profession, many lenders offer preferential interest rates to accountants. This could result in lower monthly payments and significant savings over the life of your mortgage. It's not uncommon for accountants to access mortgage deals that are not available to the general public.

- Higher Borrowing Capacity and Utilisation of Income Multiples - One of the key advantages for accountants is the ability to borrow more than the typical applicant due to higher income multiples. This allows you to purchase a property that might otherwise be out of reach

- Utilisation of Retained Profits for Self-Employed Accountants - For self-employed accountants, certain lenders may allow the inclusion of retained profits in your mortgage application. This can significantly boost your borrowing potential, especially if you've reinvested income back into your business.

How Much Can Accountants Borrow?

The amount you can borrow as an accountant depends on several factors, including your income, employment status, and the lender's specific criteria. In the UK, most accountants can expect to borrow up to 5-6 times their annual income, with some lenders offering even higher multiples for senior professionals or those with substantial deposits.

Need a refresher on how much you can borrow? Use our mortgage calculator below:

Will Student Debt Affect Your Borrowing Power?

In the UK, student loans are often a concern for recent graduates, but they typically do not impact your credit rating. Lenders are more interested in your current income and overall financial health. However, student loan repayments are considered in affordability assessments, which might slightly reduce the amount you can borrow.

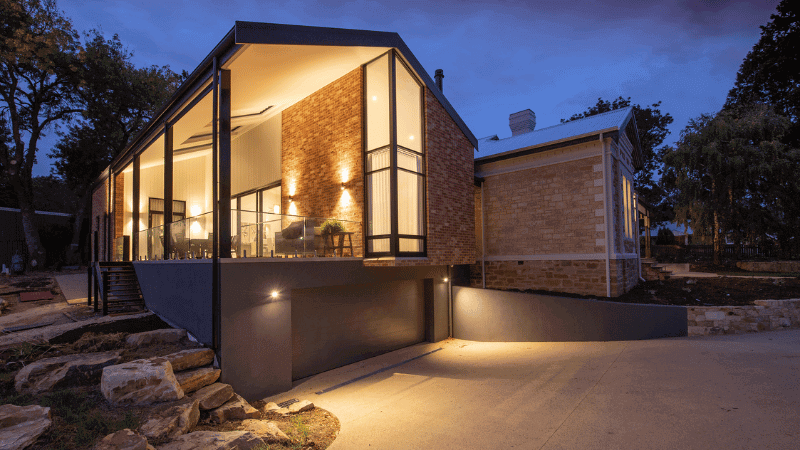

Property Investment Opportunities for Accountants

Given the stability and growth potential of the accounting profession, property investment is a viable option for accountants looking to diversify their income. Many accountants take advantage of favourable mortgage terms to invest in buy-to-let properties or second homes.

Detailed Steps for Application

- Prepare Your Financial Documents: Gather all necessary documents, including your latest tax returns, proof of income, and bank statements. Self-employed accountants should have at least two years of accounts ready.

- Check Your Credit Score: Ensure your credit score is in good shape. If there are any discrepancies, work to resolve them before applying for a mortgage.

- Consult a Mortgage Broker: A broker specialising in mortgages for professionals can provide tailored advice and help you find the best lender for your situation.

- Get a Mortgage in Principle: Secure a mortgage in principle to know how much you can borrow, giving you confidence when making offers on properties.

- Submit Your Application: Once you've found a property, submit your mortgage application with all the required documentation. Your broker can assist in ensuring everything is in order.

- Complete the Process: Upon approval, work with your solicitor to complete the property purchase. Ensure you understand the terms of your mortgage agreement.

How a Mortgage Broker Can Assist Accountants

Navigating the mortgage market can be complex, especially with the specific needs of accountants. A mortgage broker specialising in professional mortgages can:

- Identify lenders that understand the unique aspects of an accountant's income and career trajectory

- Help you package your mortgage application to maximise your borrowing potential

- Negotiate preferential rates and terms that you might not be able to access on your own

Using a broker can be particularly beneficial if you have a complex financial situation, such as being self-employed or newly qualified. So don’t hesitate to get in contact.

Contact us at Clifton Private Finance today

For expert advice on mortgages for accountants and professional mortgages. We specialise in helping professionals like you navigate the mortgage market to find the best possible terms.

To see what we can do for you call us on 0203 900 4322 or book a free consultation below.