Categories

Finance Lease | The Complete Guide

Asset finance is one of the most important financial products available for businesses in the UK, providing companies with the ability to expand and develop their businesses with the physical tools that are essential to go about their work.

While it comes in multiple forms, for many, the primary line of asset finance is that of finance leasing - but how does finance leasing truly work and why is it such a reliable and useful product?

Table of Contents

What is a Finance Lease For?

Finance Lease vs. Hire Purchase and Contract Lease

3 Examples of Asset Finance

The Nitty Gritty of Finance Leasing - 5 Things To Know

When to Choose a Finance Lease

How to Get a Finance Lease

What is a Finance Lease For?

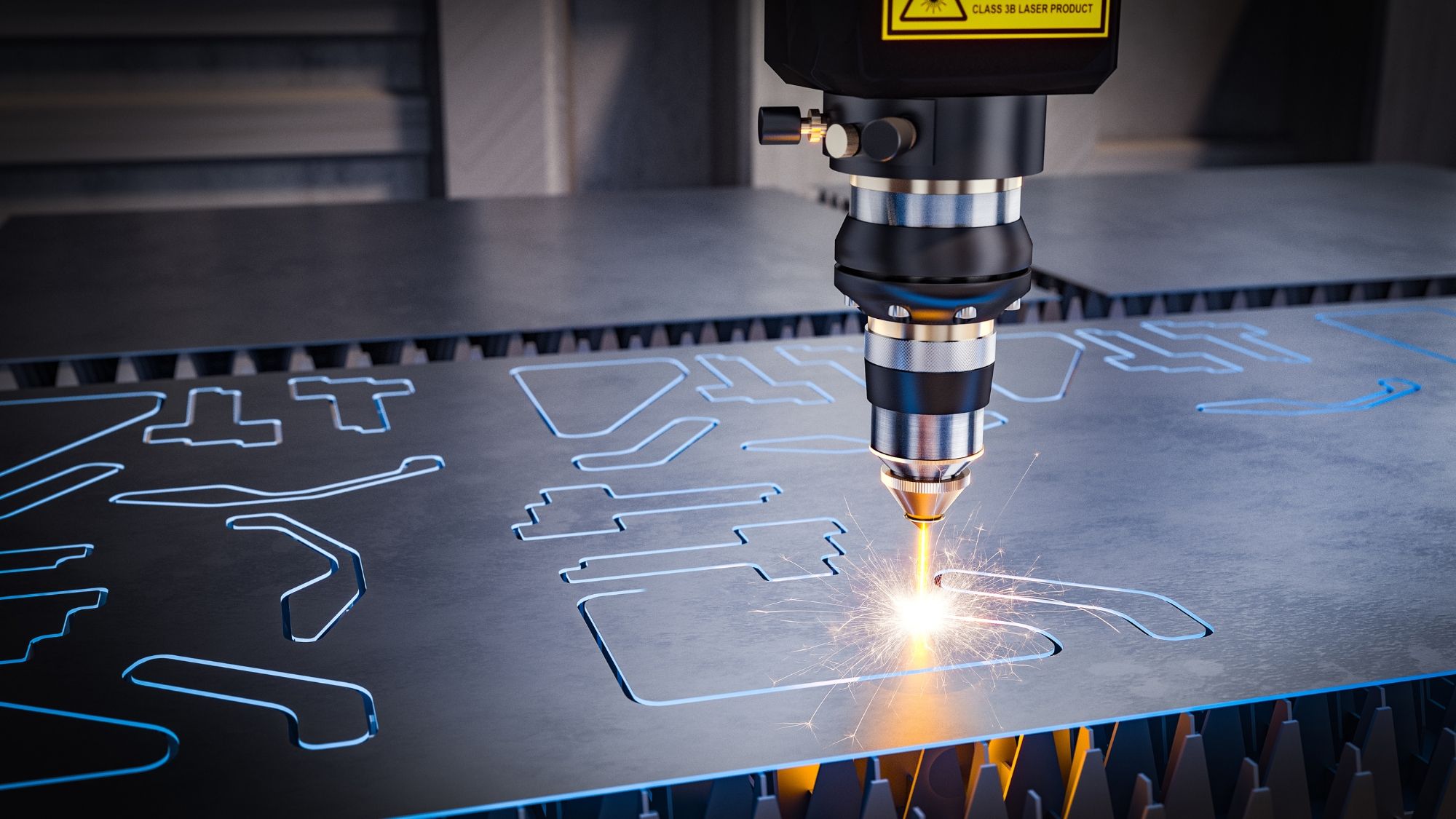

A finance lease is one of the three main types of asset finance, a group of products that are designed to provide companies the ability to invest in physical assets that might otherwise be too costly to be within reach. Such as, for example, equipment, vehicles, plant machinery, or even furniture.

With a finance lease, your business is able to afford the latest technologies, the newest state-of-the-art equipment, or company vehicles that present you and your team positively.

Working with the right equipment is vital if you want your company to prosper. The alternative is struggling at the low end, forever concerning yourself with equipment that struggles to perform the task, often worrying about repair bills or being out of date.

Imagine the software company that cannot afford the latest computer equipment; a delivery firm unable to invest in newer vans; a medical company without access to essential research equipment; or a construction company working without safe and reliable plant machinery. In all these cases and many more, finance leasing provides a way to get what you need without major capital investment, turning the need for thousands of pounds into easy-to-afford monthly repayments.

In short, a finance lease allows your company to get its hands on brand new equipment that you couldn’t otherwise afford, for a regular monthly payment plan.

Looking into finance leases for you? Get an overview of your options by booking a call with one of our experts.

Finance Lease vs. Hire Purchase and Contract Lease

Finance Lease vs. Hire Purchase

The first alternative form of asset finance to consider against finance leasing is that of the hire purchase. The key difference between the two is regarding ownership. Hire purchase is designed for companies that want to ultimately own the asset, while finance lease is more flexible - at the end of a finance lease you can choose to pay to own the asset or simply hand it back.

Finance Lease vs. Contract Lease

The second alternative form of asset finance to weigh against finance leasing is contract leasing. Here, the finance lease represents a more flexible (and often cheaper) model that is designed to give your company the feel of ownership - for example, with a standard finance lease, both the choice of how you use the equipment and its maintenance are your responsibility.

The Spectrum of Leasing

Asset finance can be seen as a spectrum, with hire purchase on one side representing full ownership and responsibility for the asset, and contract leasing on the other side, representing a rental agreement with minimal responsibility for the asset. Finance lease sits neatly in the middle, straddling both sides of this arrangement with the greatest level of flexibility among all three.

Having a Car - 3 Examples of Asset Finance

One way to look at the three forms of asset finance is to consider the purchase or lease of a car.

With hire purchase, you own the car. You pay a large initial sum (known as the deposit), and then have an ongoing loan-style repayment to pay off the car. During the whole time, the car is your responsibility to maintain and insure, and if anything goes wrong, it falls squarely on your shoulders. At the end of the contract, the loan is paid and the car is 100% yours.

With finance lease, you don’t own the car while the contract is in place. You pay a smaller initial sum (often three months’ lease), and a smaller regular monthly lease amount. When the contract is complete (typically between one and three years), you have the opportunity to pay a final balloon payment to purchase the car, or you can simply give it back. While you are using the car, the maintenance and insurance are your responsibility.

A contract lease means you are renting the car. At no point are you going to own it, but equally, you don’t have to worry about its upkeep (and often, its insurance). When the contract is complete, you hand back the car and that’s it. The monthly cost of a contract lease is typically larger than that of a finance lease, and the car will have some restrictions, such as a clear mileage limit and a ban on taking it out of the country.

The Nitty Gritty of Finance Leasing - 5 Things To Know

By now, you should have a reasonable grasp of what a finance lease is, but it is only by understanding what’s going on under the hood, that it all becomes completely clear.

Understanding Depreciation

Finance lease takes into account a number of financial factors associated with owning an asset. One of those is equipment lifespan and another is depreciation.

Equipment Lifespan

Nothing lasts forever. When you purchase a piece of equipment (an asset), there may be a feeling that you will always have access to this equipment; after all, it is yours and no one is going to take it away.

However, that’s a fallacy, as all physical assets eventually become useless. Computers become obsolete, no longer able to run the latest software or even perform the tasks they were originally built for; vehicles suffer from considerable wear and tear and end up heading to the scrapyard; even furniture, such as chairs or desks, will eventually break and stop being able to be used.

The idea that any physical asset lasts forever is simply false. Instead, each piece of equipment has a lifespan, a length of time after which it is no longer of significant value and the cost to repair it is no longer viable. This is its equipment lifespan, and it is often shorter than most people consider.

Depreciation

Depreciation is how much the value of your asset falls as time goes on. Something that is a year old and has been used considerably for that time is worth a lot less than it was when first purchased, that same item when two years old is worth even less, and this continues until it is virtually worthless.

This drop in value is called depreciation and can be calculated based on the age and wear and tear of your asset.

Lessors and Assets

The company that provides you with the asset under a finance lease is called a lessor (you are the lessee). It is their business to provide businesses with assets and to make money off that arrangement.

Lessors do not just randomly buy assets and hope for the best. Instead, one of two things will happen:

1. Asset Investment by Market - The first is that the lessor will invest in assets that it knows have value in the market. One clear example of this is with car leasing firms. They know what cars are going to have value and will buy new cars to have as their inventory, ready to pass them on to lessees looking for vehicle finance leasing. Investing in assets this way is risky, as the lessor needs to be assured that there is demand for their assets or they will depreciate over time without being used (and therefore bringing in money).

2. Asset Investment by Demand - This second aspect sees the leasing company obtaining assets when they have a customer looking to lease one. This is a far less risky proposition, but can take time for the asset to be sourced and purchased on the lessee’s behalf.

As any asset will depreciate over time, often starting immediately upon purchase, leasing companies must be confident that their investment will make a return.

How Equipment Lifespan and Depreciation Affect Finance Leasing

Finance leasing is an agreement between lessor and lessee that one provides the asset and the other covers the cost of its use. By far, the largest factor in such a cost is the depreciation and so that is at the core of the expense.

A finance lease can, therefore, be seen as spending months covering the depreciation of the asset with some extra added on to provide value for the lessor.

Leasing Restrictions

Because you do not own the asset, the leasing company may well put restrictions on its usage. This is easiest to understand when considering vehicle leasing where a clear restriction may be in terms of annual mileage.

However, the leasing restrictions for a finance lease are often far more flexible than those attached to an operating lease. For example, assets under finance lease may be modified with agreement with the finance company, such as functional alterations to computers and other technologies, or external branding on plant machinery.

It is essential that you understand the restrictions in place for any lease prior to agreeing to the contract, as they may have a significant implication on usage.

Optional Final Payments & Selling the Asset

One of the advantages of a finance lease is its flexibility. Ultimately, decisions on ‘what to do next’ do not have to be made until the very end of the contract term, by which time the business has a far better evaluation of the asset and its importance to them.

For some, there will be a desire to keep the asset, either by taking on full ownership directly or by extending the finance lease contract; for others, the asset will have lived (or outlived) its usefulness and they will be happy to be released from the contract.

This means there are four options to lessee businesses at the end of their contract term:

- Purchase the asset by paying a final balloon payment equivalent to its current value.

- Continue the contract by extending it for a further year or more.

- Upgrade the asset by returning the original and undertaking a new lease for a similar, more modern version.

- End the lease.

Selling the Asset

It is usual that at the end of a finance lease, the asset is sold - whether or not this is to the original lessee.

Because maintenance and upkeep of the asset is the responsibility of the lessee, fees will be applicable should it be returned in a condition that doesn’t meet expectations - i.e. accounting for reasonable wear and tear. These fees are representative of the price the asset was expected to fetch at the conclusion of the contract and its actual market value once that contract comes to an end.

However, the inverse is also often true, where a lessor selling an asset to a third party receives a higher than expected return. In these cases, and depending on the finance lease contract, the additional amount may be returned to the lessee in the form of a repayment.

It is always a good idea to take good care of assets under a finance lease

When to Choose a Finance Lease

Like all asset finance, a finance lease is there to help your business obtain equipment when making a capital investment of ownership is either out of reach or considered a poor decision, perhaps due to depreciation or equipment lifespan.

Finance leasing is also good with assets that are likely to be superseded by superior models after a few years. In these cases, investing in full ownership of the asset may be inefficient, requiring its sale on the second hand market at the end of its effective equipment lifespan and using that money towards investing in a replacement model.

These administrative undertakings can add costs and difficulties on the business that’s not needed when a finance lease arrangement effectively does it all for you. The flexibility of end-of-contract finance lease ownership means that in cases where an asset proves itself to be more valuable than expected, it can be bought for permanent use anyway.

In short; a finance lease means a level of flexibility which is of considerable value in of itself.

How to Get a Finance Lease

Our team of experts at Clifton Private Finance are specialists in all manner of asset finance and are here to help you get the finance leasing you require.

What sets us apart is our ability to compare options from multiple lenders. We are completely independent and have access to the whole of market - we will put your needs at the forefront of our recommendations in terms of costs, speed, and terms.

Contact us today to discuss your finance lease requirements.

.png)